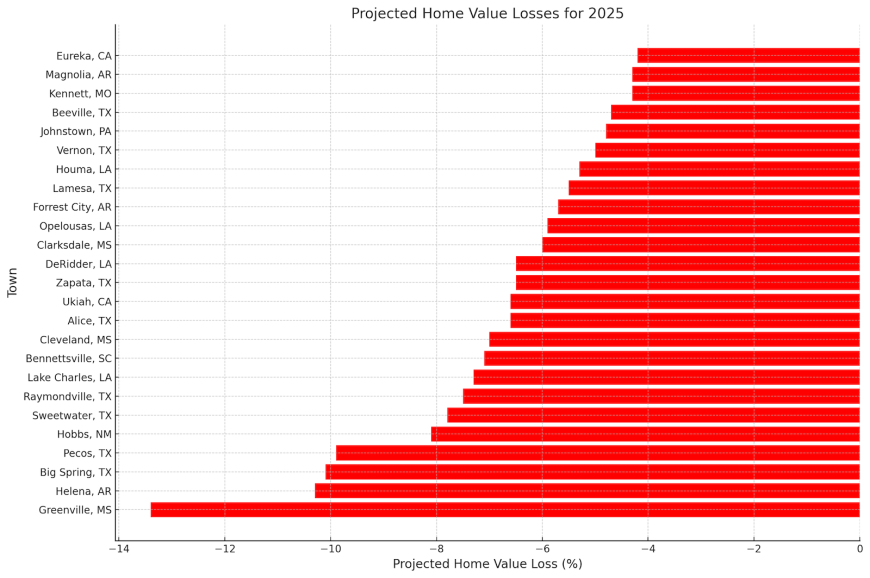

According to Zillow Home Value Index data, a concerning pattern of housing market decline is projected across select small and mid-sized markets for 2025, with anticipated losses ranging from -4.20% to -13.40%. Most notably, Texas dominates the list with nine communities facing significant declines, particularly in regions tied to energy production such as Pecos (-9.90%), Big Spring (-10.10%), and Zapata (-6.50%). The geographic concentration of these declines suggests regional economic challenges, with Louisiana placing four communities on the list and Mississippi showing three cities facing substantial value reductions.

The data reveals striking patterns about property values and projected losses. California presents an intriguing contrast, with Ukiah showing the highest absolute property value ($483,154) among all 25 markets, yet facing a -6.60% decline, while Eureka ($404,534) shows the most modest percentage decline at -4.20%. Conversely, some of the steepest percentage declines appear in markets with lower property values, such as Greenville, Mississippi, which faces the largest percentage drop (-13.40%) while having the lowest current value ($50,229). This disparity highlights how percentage declines don’t necessarily correlate with absolute dollar losses, as evidenced by Ukiah’s projected dollar decline of $31,888 being nearly five times larger than Greenville’s $6,731 reduction.

Overview Chart

Industrial diversity emerges as a critical factor in these markets, with many cities showing heavy dependence on single industries facing steeper declines. Energy-dependent communities in Texas and New Mexico show particular vulnerability, while cities with more diverse economic bases, such as Eureka, California, and Lake Charles, Louisiana, display relatively more modest declines. Notable among the findings is the prevalence of healthcare as a stabilizing force across nearly all markets, though this sector alone doesn’t appear sufficient to prevent projected declines. Educational institutions also feature prominently in many of these markets, with colleges and universities providing some economic stability despite the challenging housing outlook.

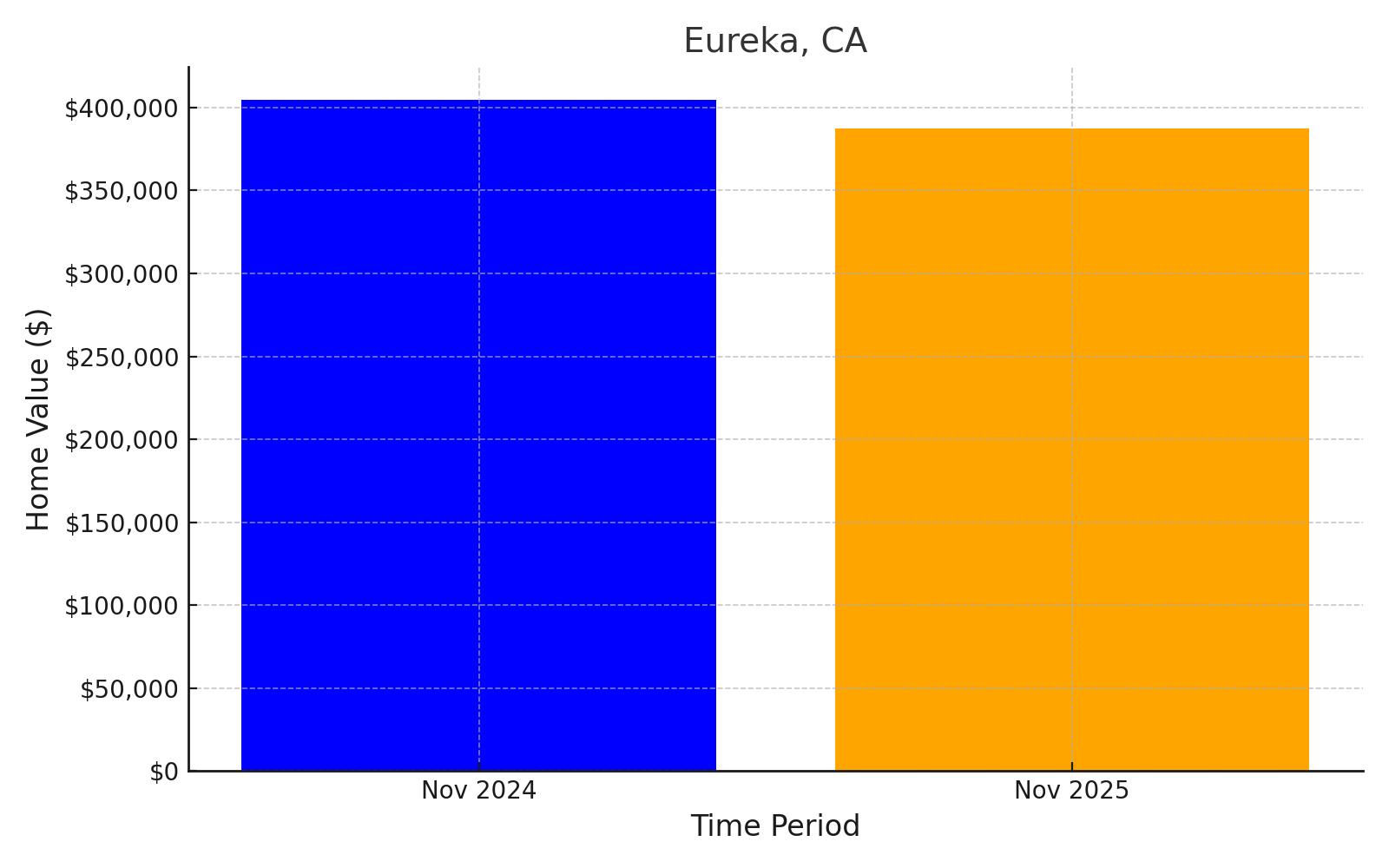

1. Eureka, California

Nestled along the rugged Northern California coast, Eureka had established a home value of $404,534 as of November 2024. Projections suggest the city will experience a 4.20% decline, bringing its value down to $387,543 by November 2025 – a dollar loss of $16,991. The city’s resilience shines through its economic tapestry, where maritime commerce, healthcare, and creative industries interweave to create a robust local ecosystem. From the bustling port to the thriving arts scene, Eureka demonstrates how diverse economic foundations can help cushion against housing market fluctuations.

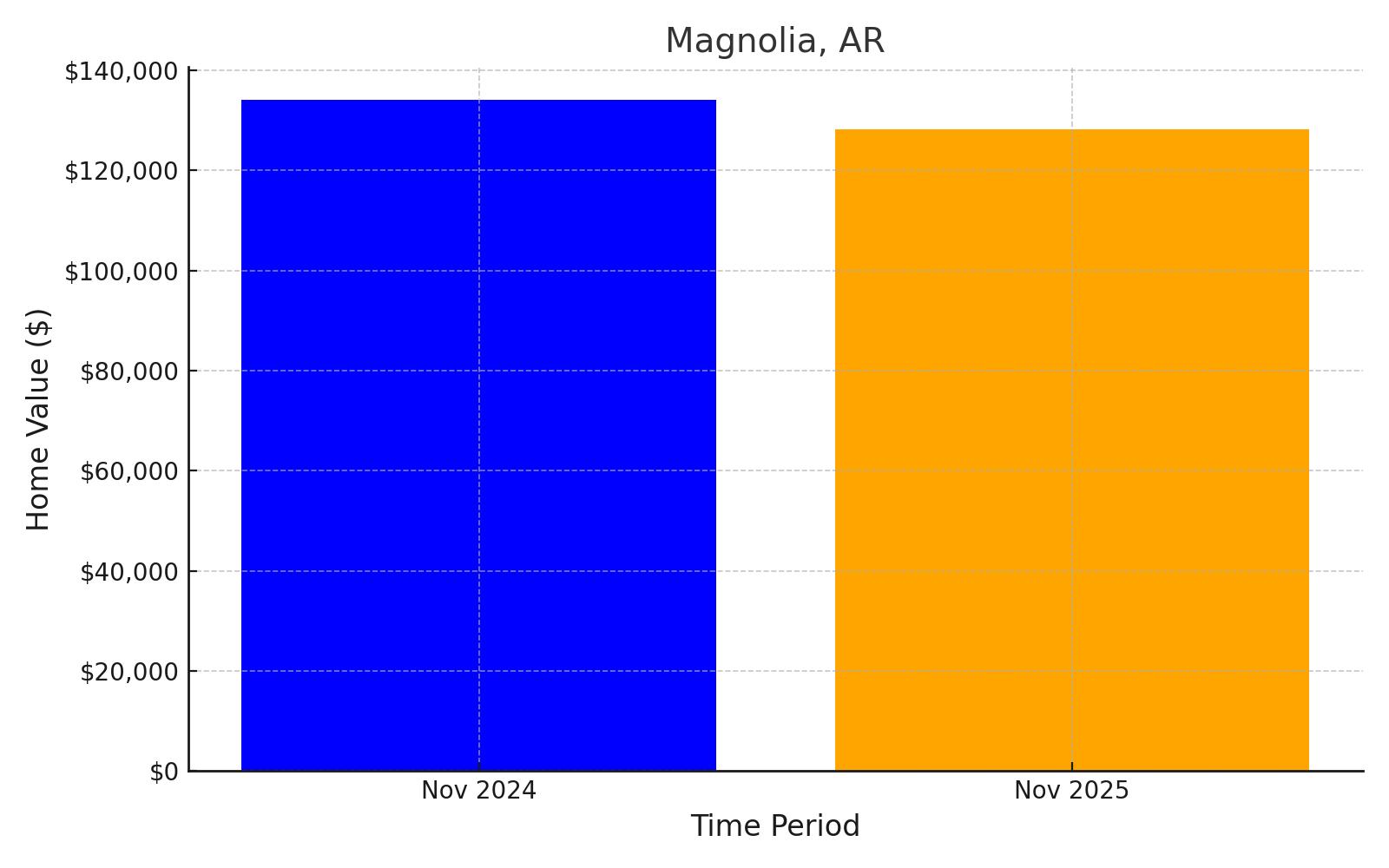

2. Magnolia, Arkansas

With a home value of $134,051 recorded in November 2024, Magnolia is poised to navigate a 4.30% decline, reaching $128,287 by November 2025 – a reduction of $5,764. The city’s economic narrative is richly textured, with Southern Arkansas University acting as a vital heartbeat. Manufacturing, education, and service industries create a dynamic local economy that adapts and evolves. The legacy of timber and oil continues to whisper through the city’s economic corridors, while healthcare and retail sectors provide additional economic stability.

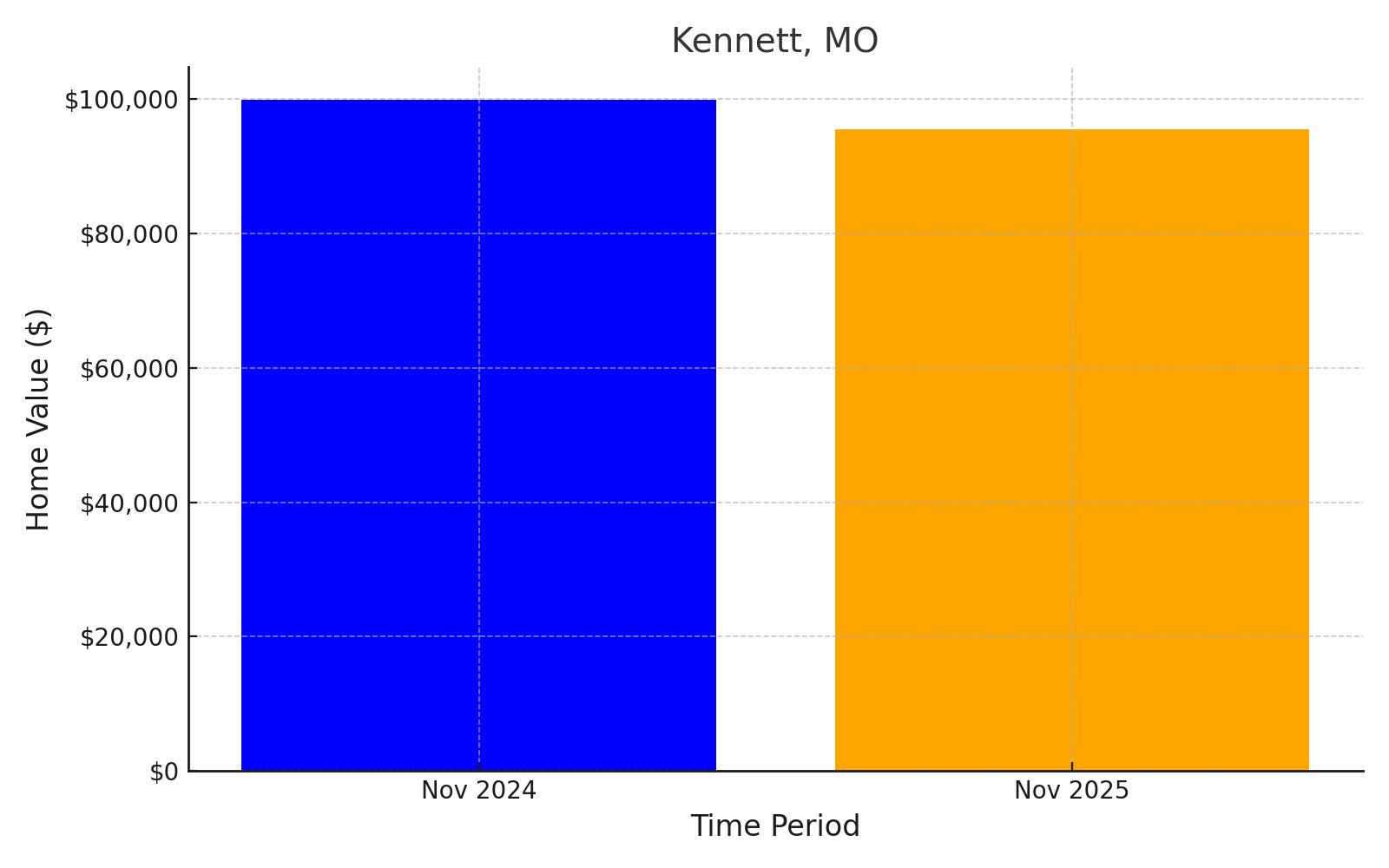

3. Kennett, Missouri

Kennett’s economic landscape in November 2024 reflected a home value of $99,837, with projections indicating a 4.30% decline to $95,544 by November 2025 – a decrease of $4,293. Rooted deeply in the fertile Missouri Bootheel, the city’s identity is intrinsically linked to agricultural prosperity. Beyond farming, Kennett has cultivated a robust healthcare infrastructure and developed small-scale manufacturing and retail sectors that provide economic diversification and resilience.

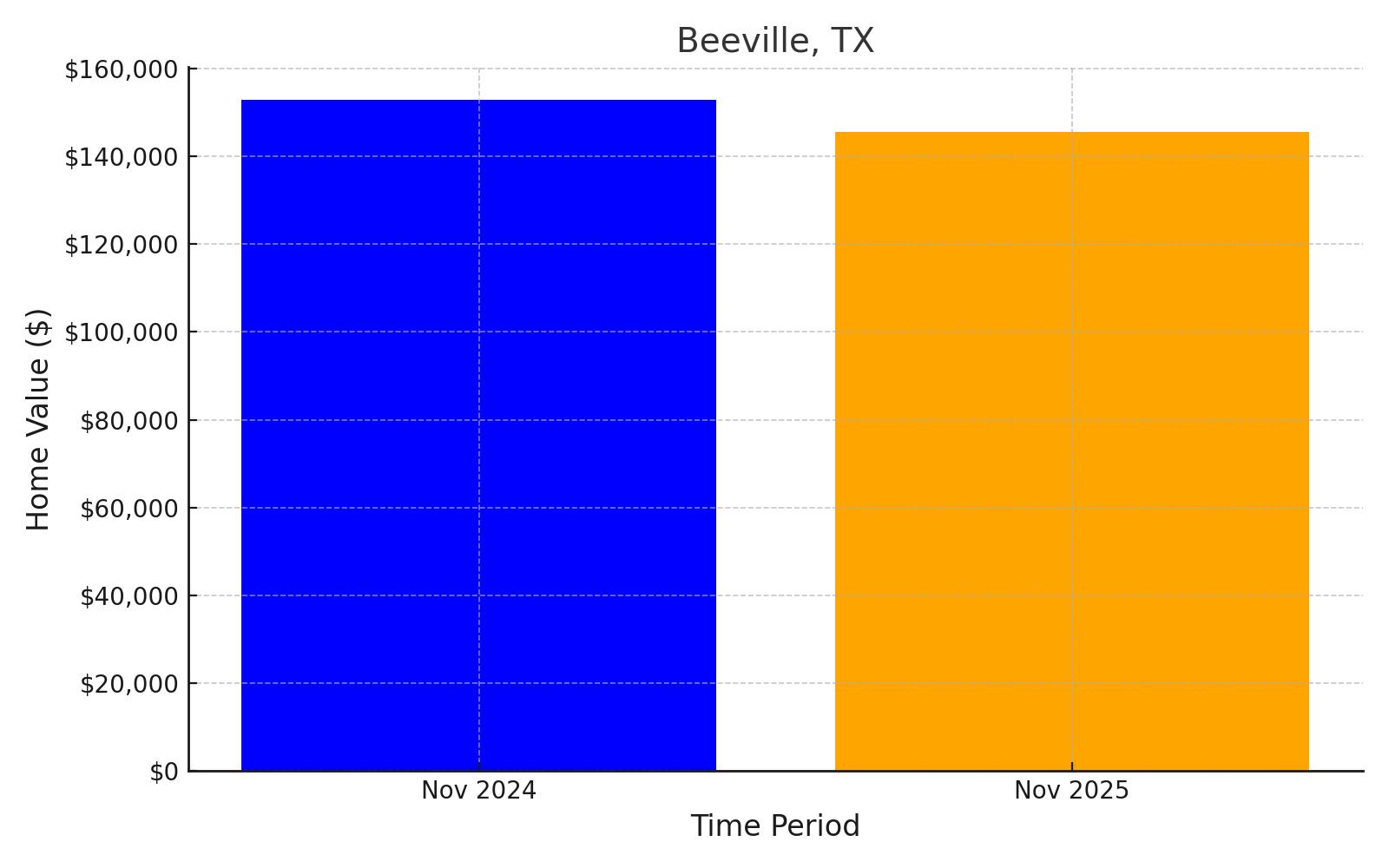

4. Beeville, Texas

By November 2024, Beeville’s home value stood at $152,806, with forecasts suggesting a 4.70% decline to $145,624 by November 2025 – a reduction of $7,182. Coastal Bend College anchors the educational landscape, while the Texas Department of Criminal Justice provides a steady governmental employment base. Agricultural traditions blend seamlessly with modern institutional presence, creating a unique economic mosaic that helps buffer against market volatility.

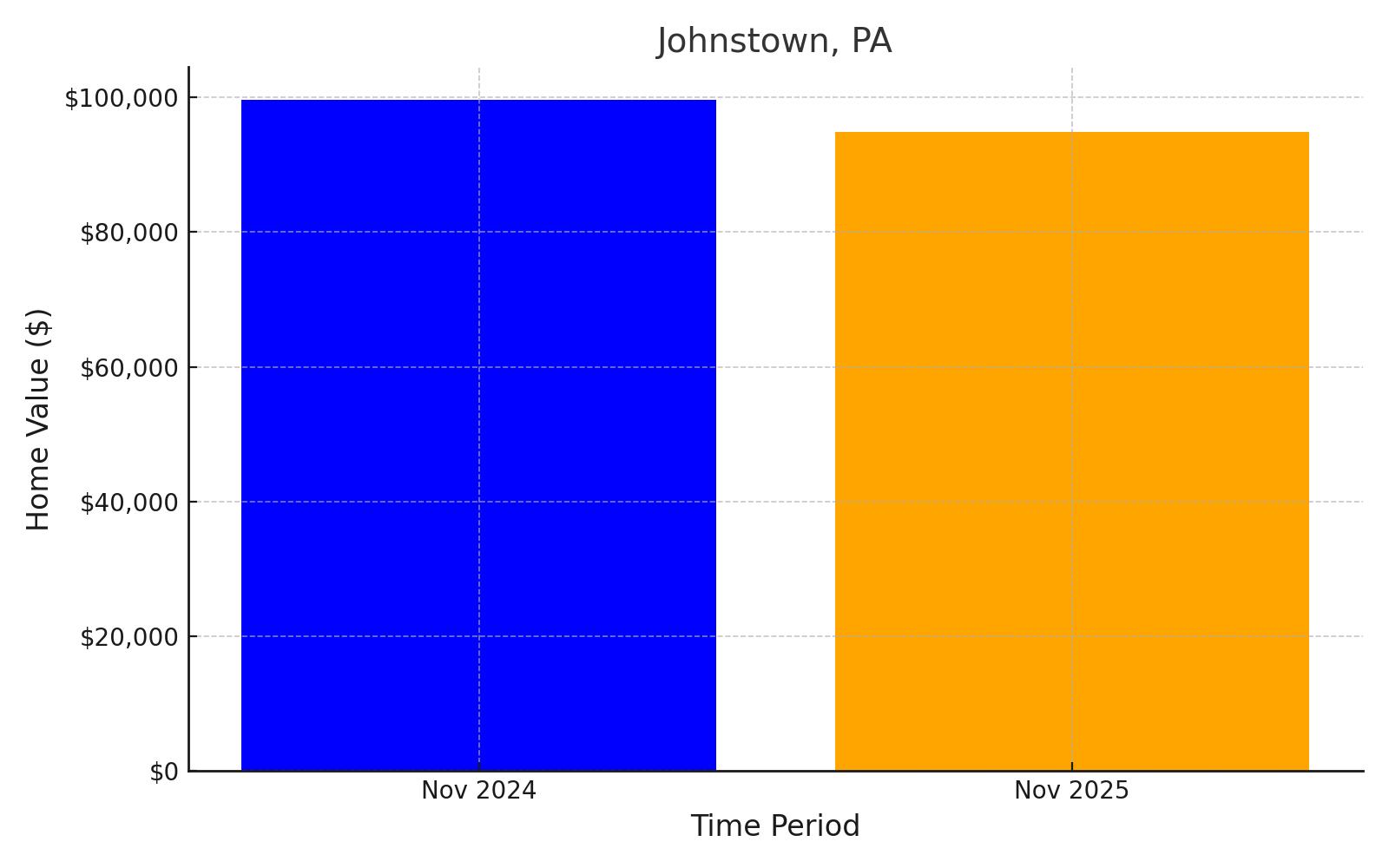

5. Johnstown, Pennsylvania

Johnstown’s home value reached $99,589 in November 2024, with projections pointing to a 4.80% decline to $94,808 by November 2025 – a loss of $4,781. Once a steel manufacturing powerhouse, the city has masterfully reinvented itself. The University of Pittsburgh at Johnstown breathes educational vitality, while defense contracts and light manufacturing continue to drive economic innovation. Tourism celebrating the city’s industrial heritage adds another layer of economic complexity.

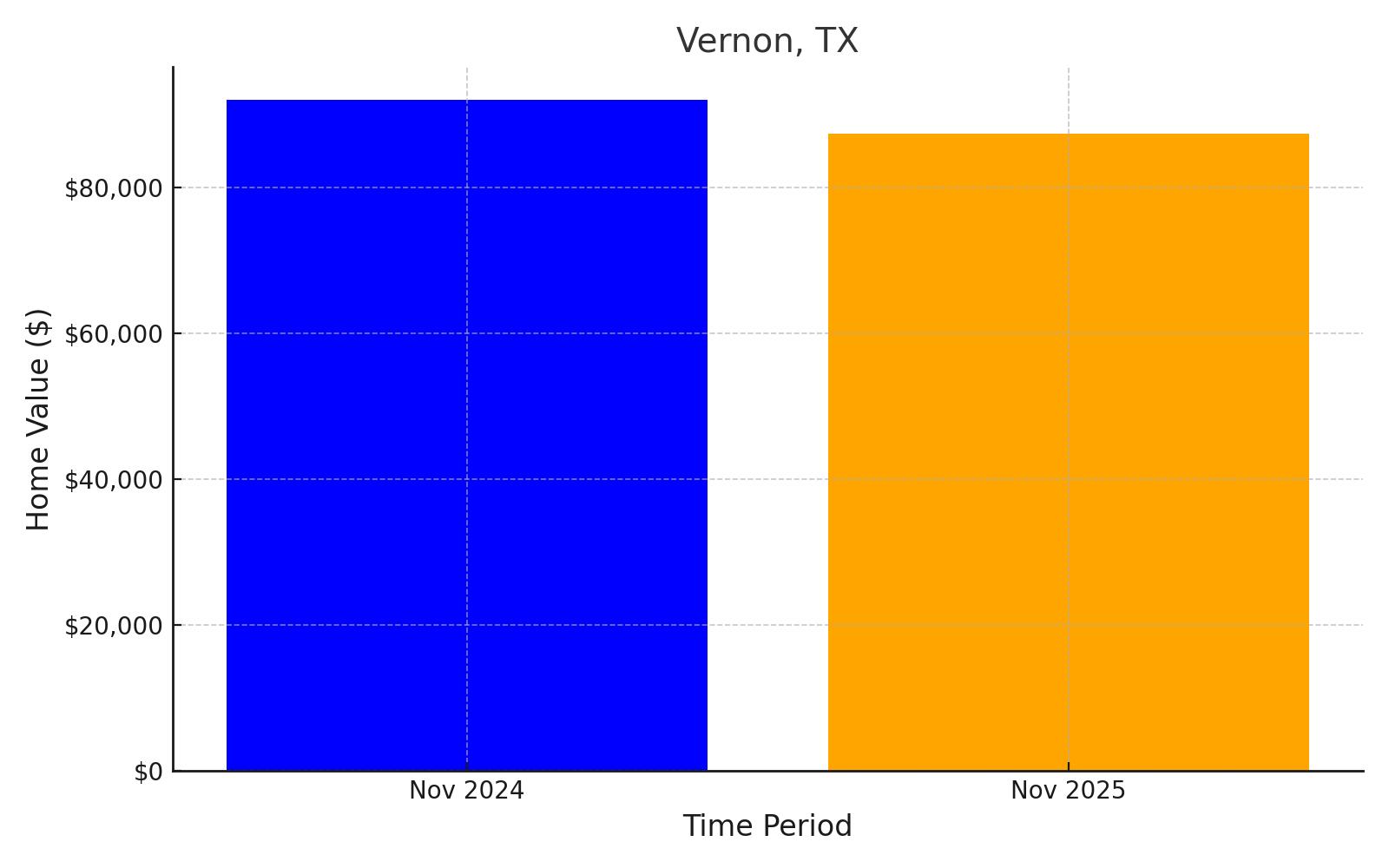

6. Vernon, Texas

Vernon’s economic snapshot in November 2024 showed a home value of $91,979, with expectations of a 5.00% decline to $87,380 by November 2025 – a decrease of $4,599. Vernon College serves as an educational cornerstone, while agriculture and manufacturing form the city’s economic backbone. Cattle ranching, diverse farming practices, and a robust healthcare sector create a resilient local economy that adapts to changing market conditions.

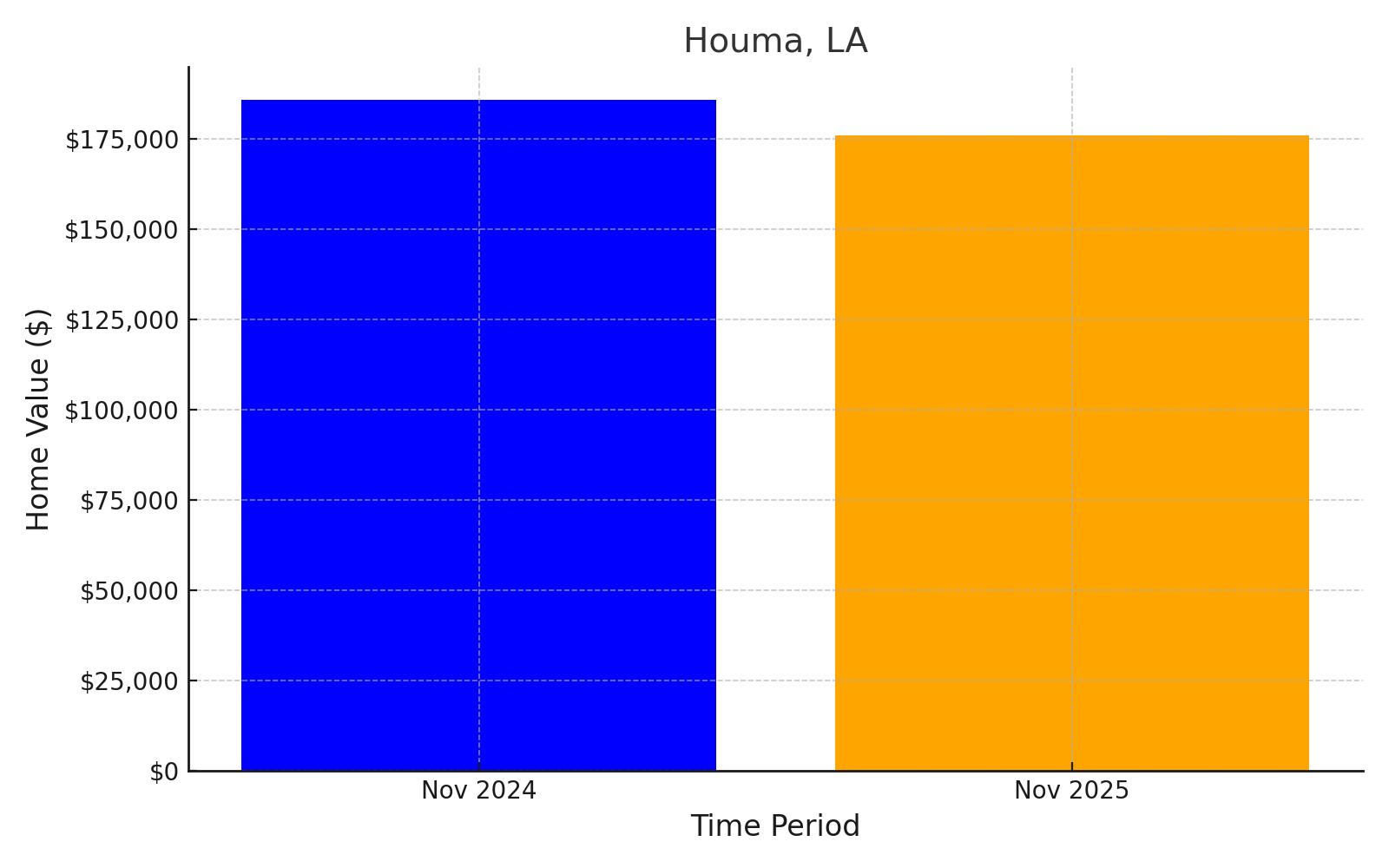

7. Houma, Louisiana

As of November 2024, Houma’s home value stood at $185,709, with projections indicating a 5.30% decline to $175,867 by November 2025 – a reduction of $9,842. The city’s economic rhythm pulses with offshore oil and gas operations, maritime commerce, and a vibrant seafood industry. Terrebonne General Medical Center anchors the healthcare landscape, while Cajun cultural tourism provides additional economic dimension, showcasing Houma’s ability to leverage its unique cultural and industrial heritage.

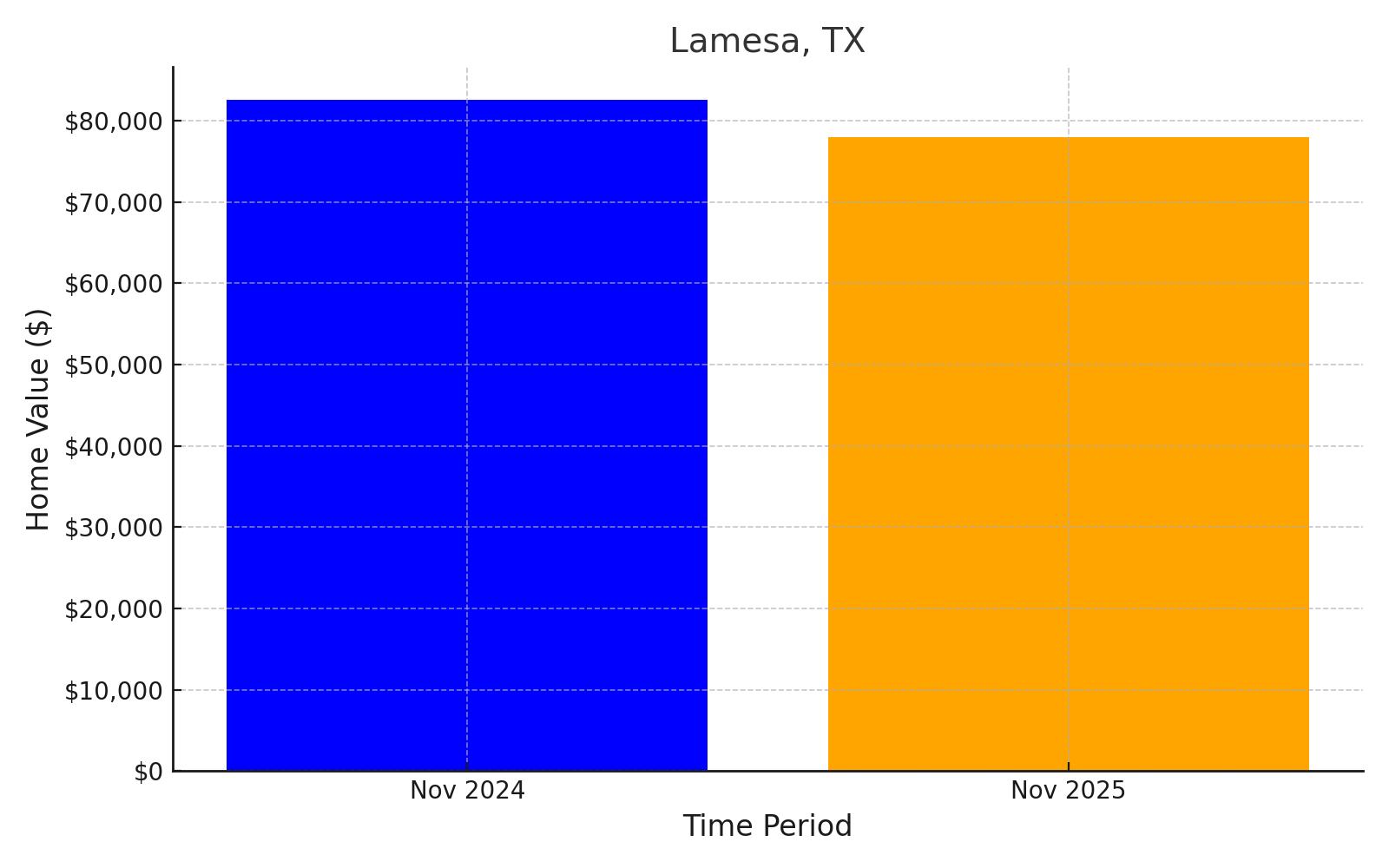

8. Lamesa, Texas

Lamesa’s economic profile in November 2024 revealed a home value of $82,533, with forecasts suggesting a 5.50% decline to $77,994 by November 2025 – a loss of $4,539. Cotton farming dominates the local landscape, with processing facilities and agricultural support industries creating a specialized economic ecosystem. The local medical center not only provides essential healthcare but serves as a critical employment hub, illustrating how small towns leverage institutional presence for economic stability.

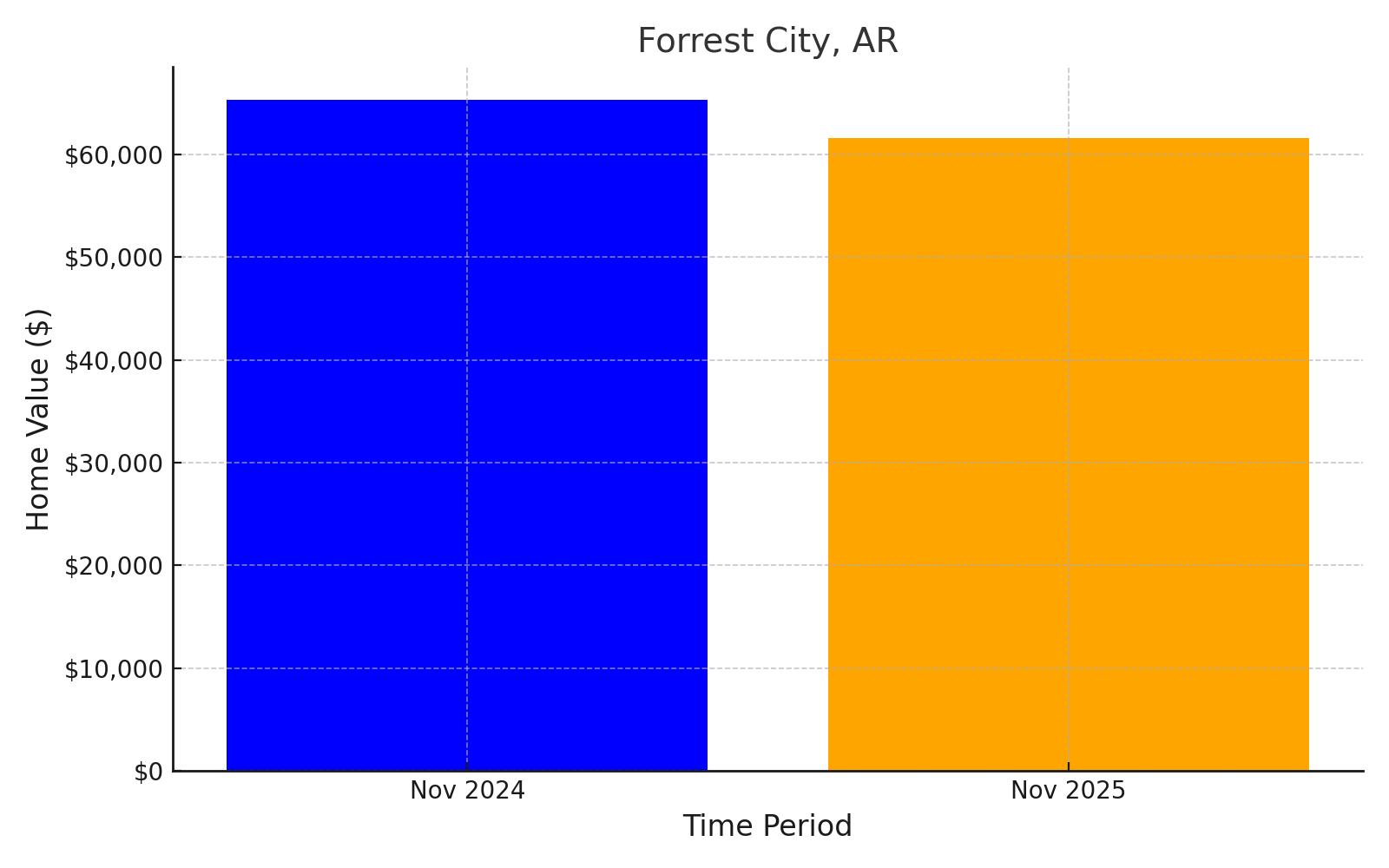

9. Forrest City, Arkansas

By November 2024, Forrest City’s home value was $65,273, with predictions of a 5.70% decline to $61,552 by November 2025 – a decrease of $3,721. East Arkansas Community College serves as an educational and economic lighthouse, while manufacturing and correctional facilities provide diverse employment opportunities. The surrounding Delta region’s agricultural legacy continues to subtly influence the city’s economic landscape.

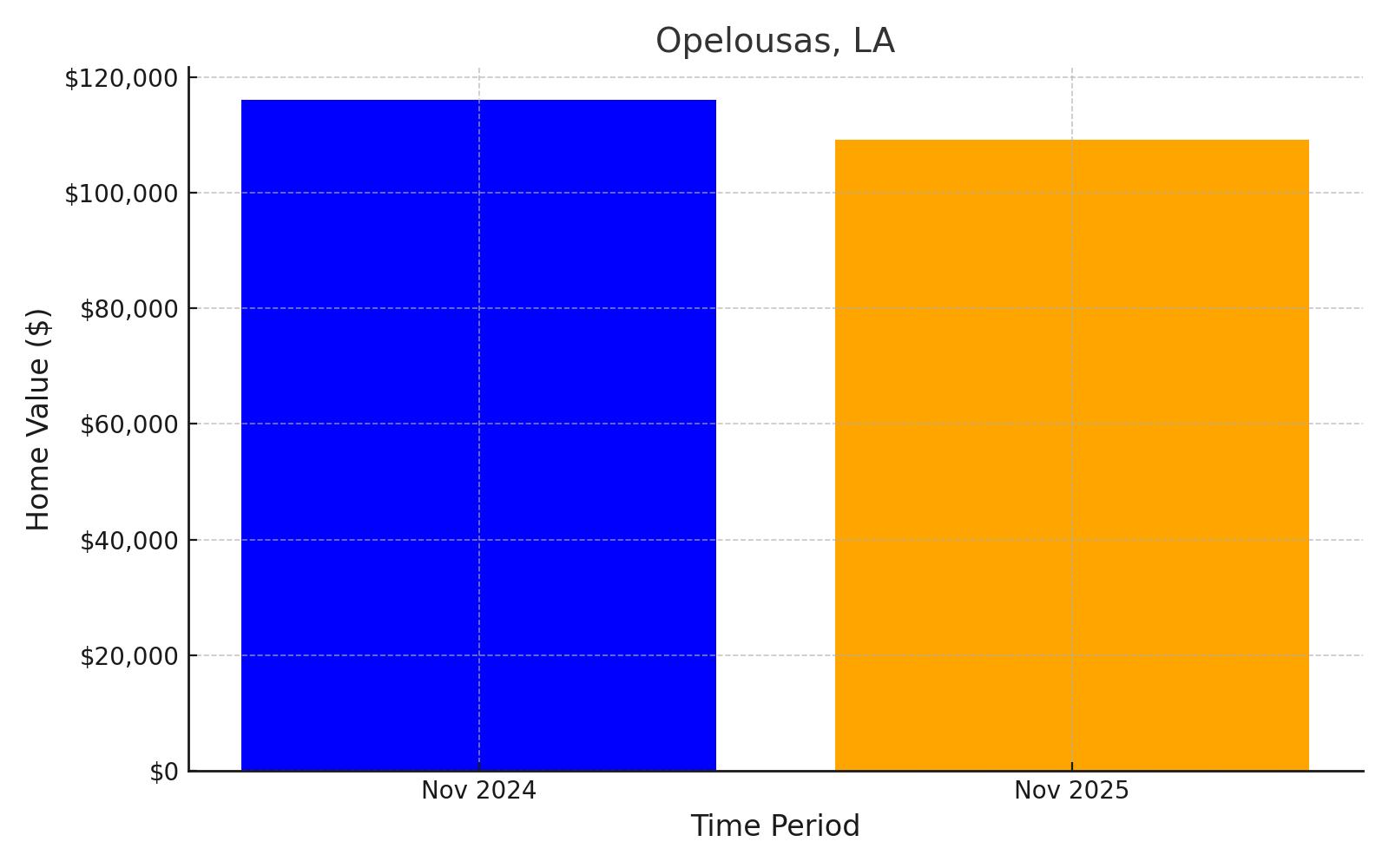

10. Opelousas, Louisiana

Opelousas entered November 2024 with a home value of $115,987, facing a 5.90% decline to $109,144 by November 2025 – a reduction of $6,843. As one of Louisiana’s most historic cities, Opelousas weaves together traditional industries with modern economic strategies. Government services, agricultural processing, and Cajun cultural tourism create a multifaceted economic profile that helps mitigate market volatility.

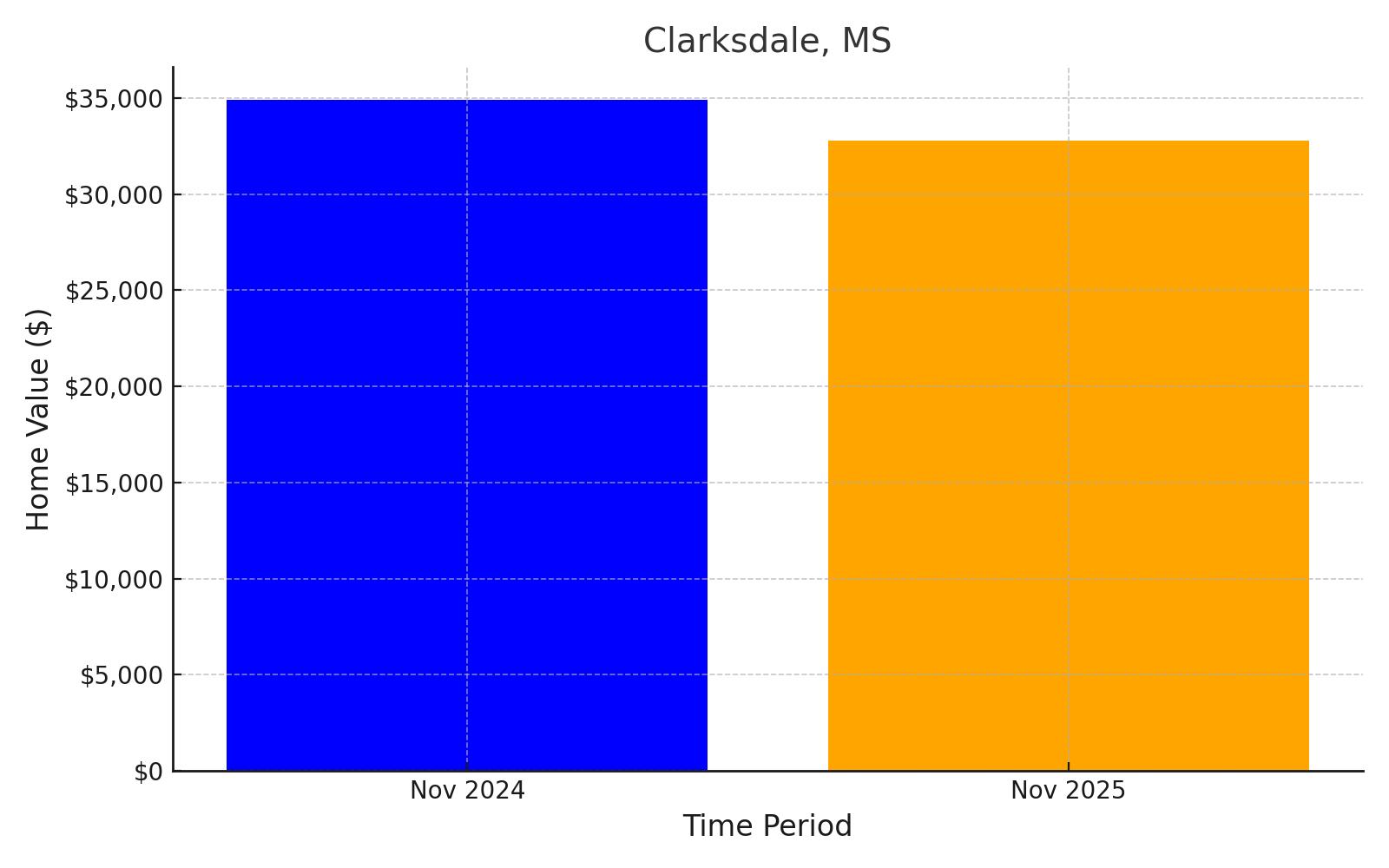

11. Clarksdale, Mississippi

Clarksdale’s home value stood at $34,884 in November 2024, with projections of a 6.00% decline to $32,791 by November 2025 – a loss of $2,093. The city’s economic transformation is embodied in its blues heritage tourism, healthcare services, and gradual shift from traditional agricultural roots. Manufacturing and retail sectors provide additional economic scaffolding in this culturally rich Mississippi Delta community.

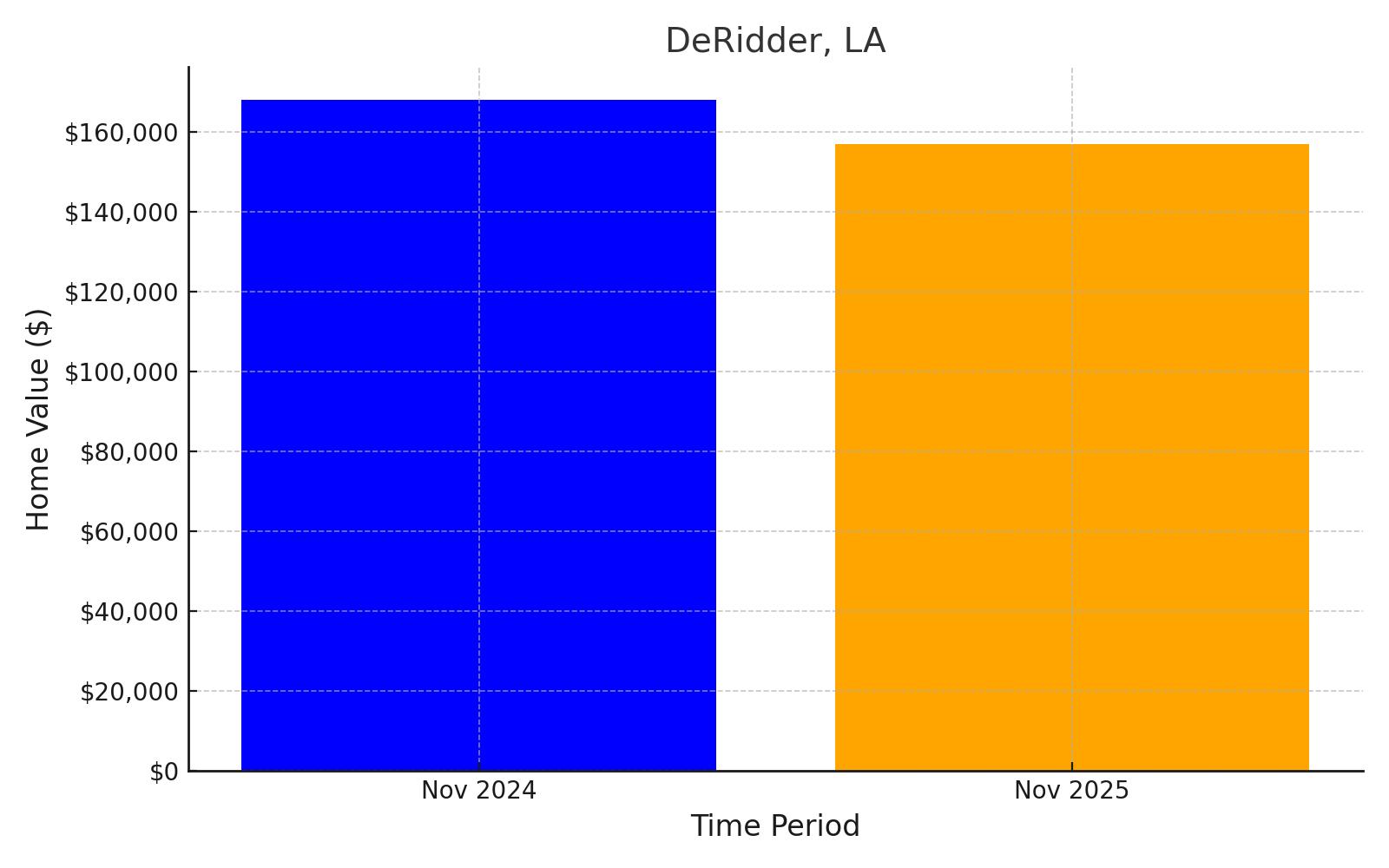

12. DeRidder, Louisiana

As of November 2024, DeRidder’s home value reached $167,890, with expectations of a 6.50% decline to $156,977 by November 2025 – a decrease of $10,913. Fort Polk’s military presence provides a robust economic foundation, complemented by the city’s deep-rooted timber industry. Healthcare services and advanced manufacturing continue to diversify the local economic landscape, creating resilience against market fluctuations.

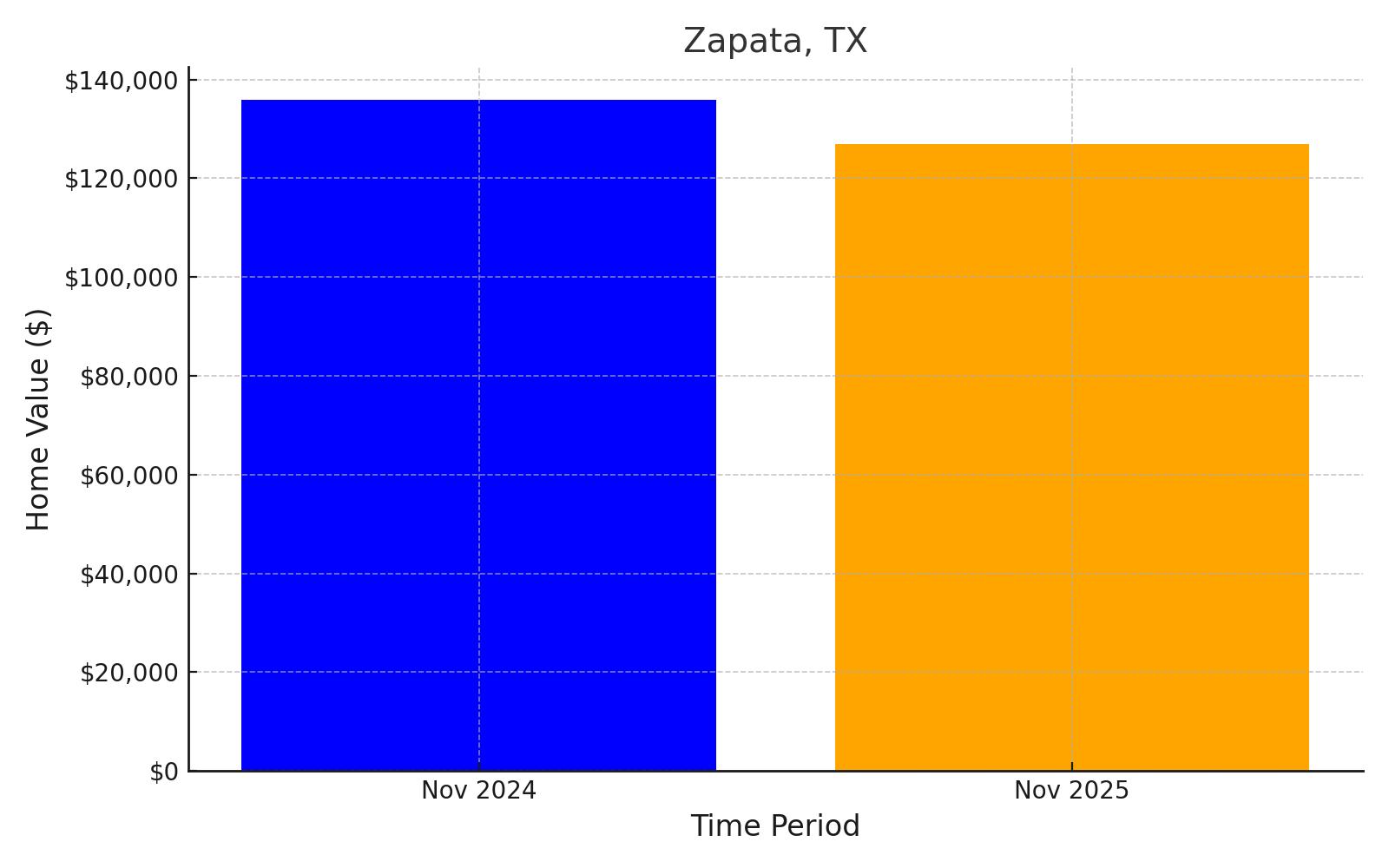

13. Zapata, Texas

Zapata’s home value in November 2024 stood at $135,819, with projections indicating a 6.50% decline to $126,991 by November 2025 – a reduction of $8,828. Straddling the intersection of ranching, energy production, and tourism, Zapata represents the complex economic tapestry of rural Texas. Falcon Lake’s recreational economy provides a unique counterpoint to traditional industries, while government services and retail sectors offer additional economic stability.

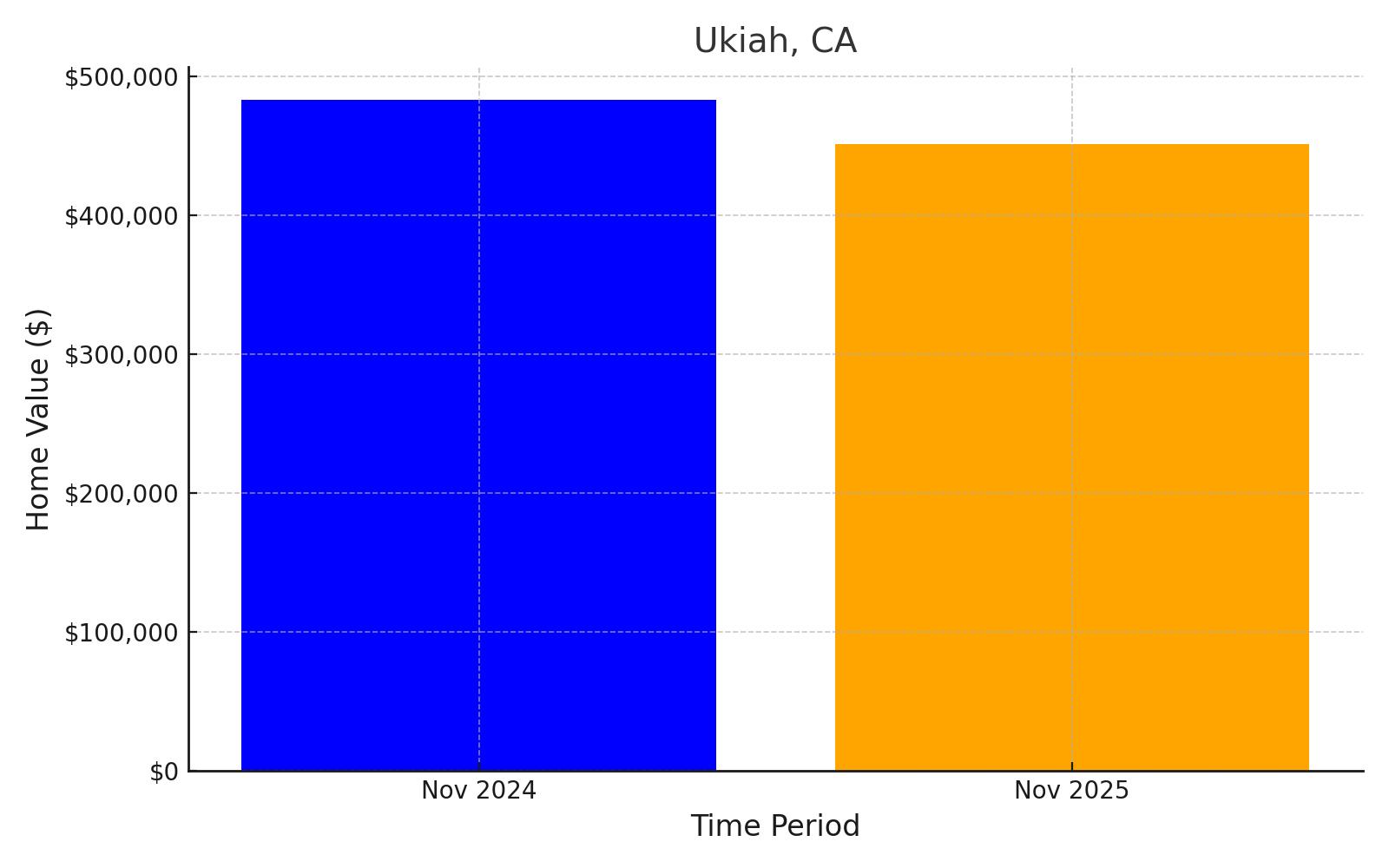

14. Ukiah, California

Ukiah boasted the highest home value in the study at $483,154 in November 2024, with forecasts suggesting a 6.60% decline to $451,266 by November 2025 – a substantial dollar loss of $31,888. Nestled in California’s wine country, Ukiah epitomizes economic diversity. The wine industry, healthcare sector, and tourism create a sophisticated economic ecosystem that helps buffer against market volatility.

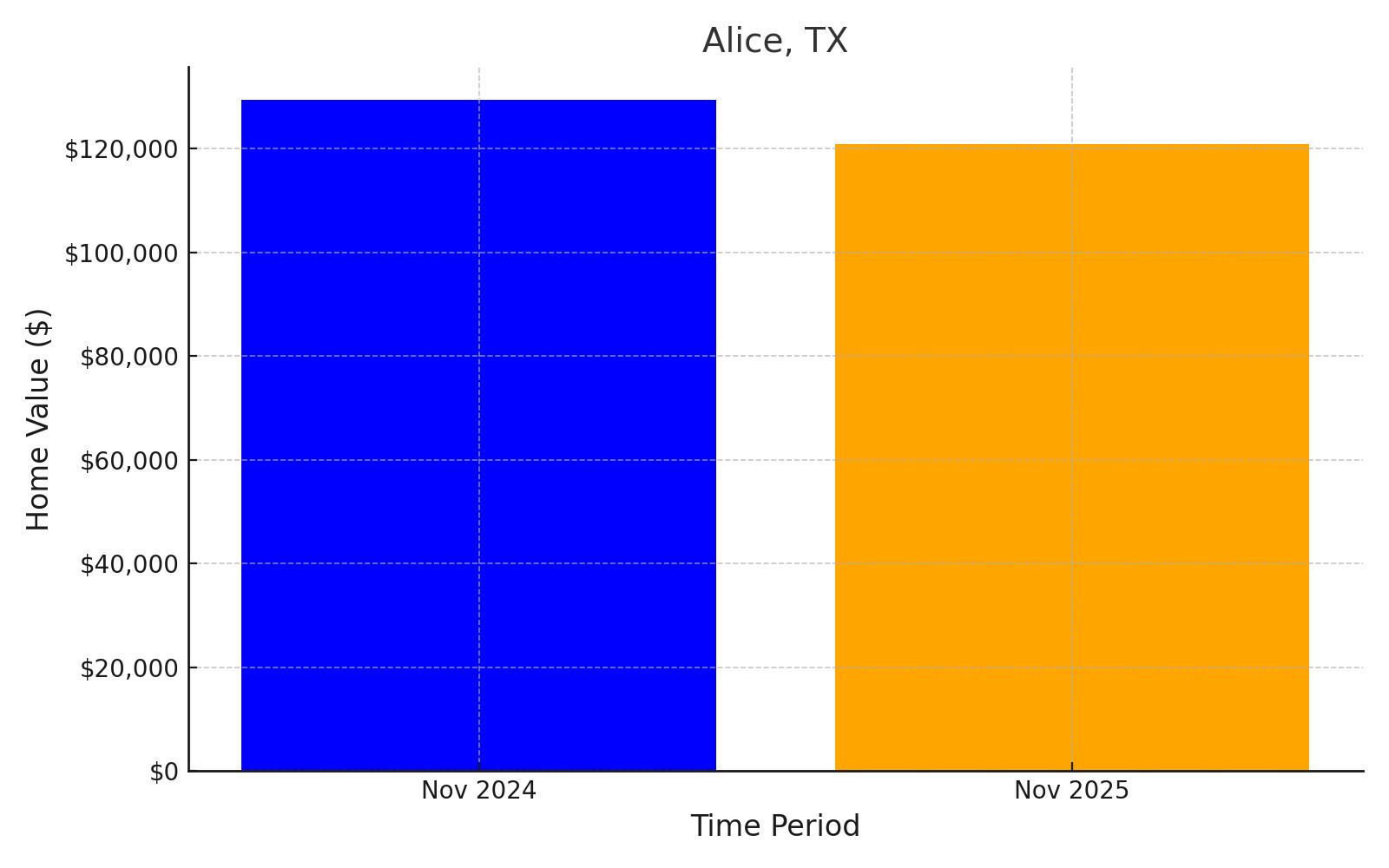

15. Alice, Texas

Alice’s home value reached $129,338 in November 2024, with projections of a 6.60% decline to $120,802 by November 2025 – a decrease of $8,536. Oil and gas industries dominate the economic landscape, while Coastal Bend College and healthcare services provide critical alternative economic foundations. Ranching continues its historical role, creating a layered economic environment that adapts to changing market conditions.

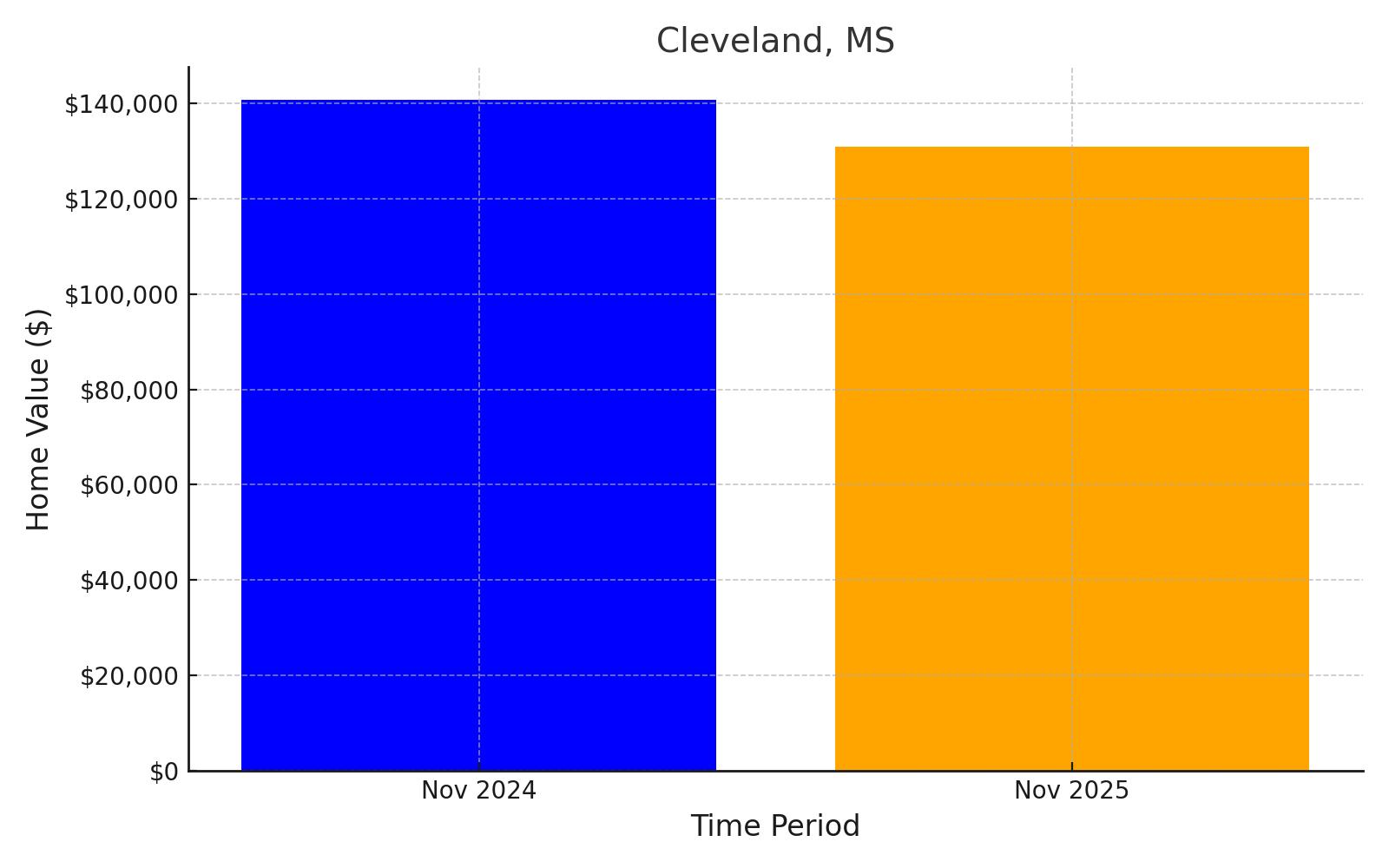

16. Cleveland, Mississippi

Cleveland’s home value stood at $140,648 in November 2024, with projections of a 7.00% decline to $130,803 by November 2025 – a loss of $9,845. Delta State University anchors the city’s economic landscape, while healthcare services and Blues heritage tourism create a multifaceted economic profile. Agricultural traditions provide underlying economic stability in this dynamic Mississippi Delta community.

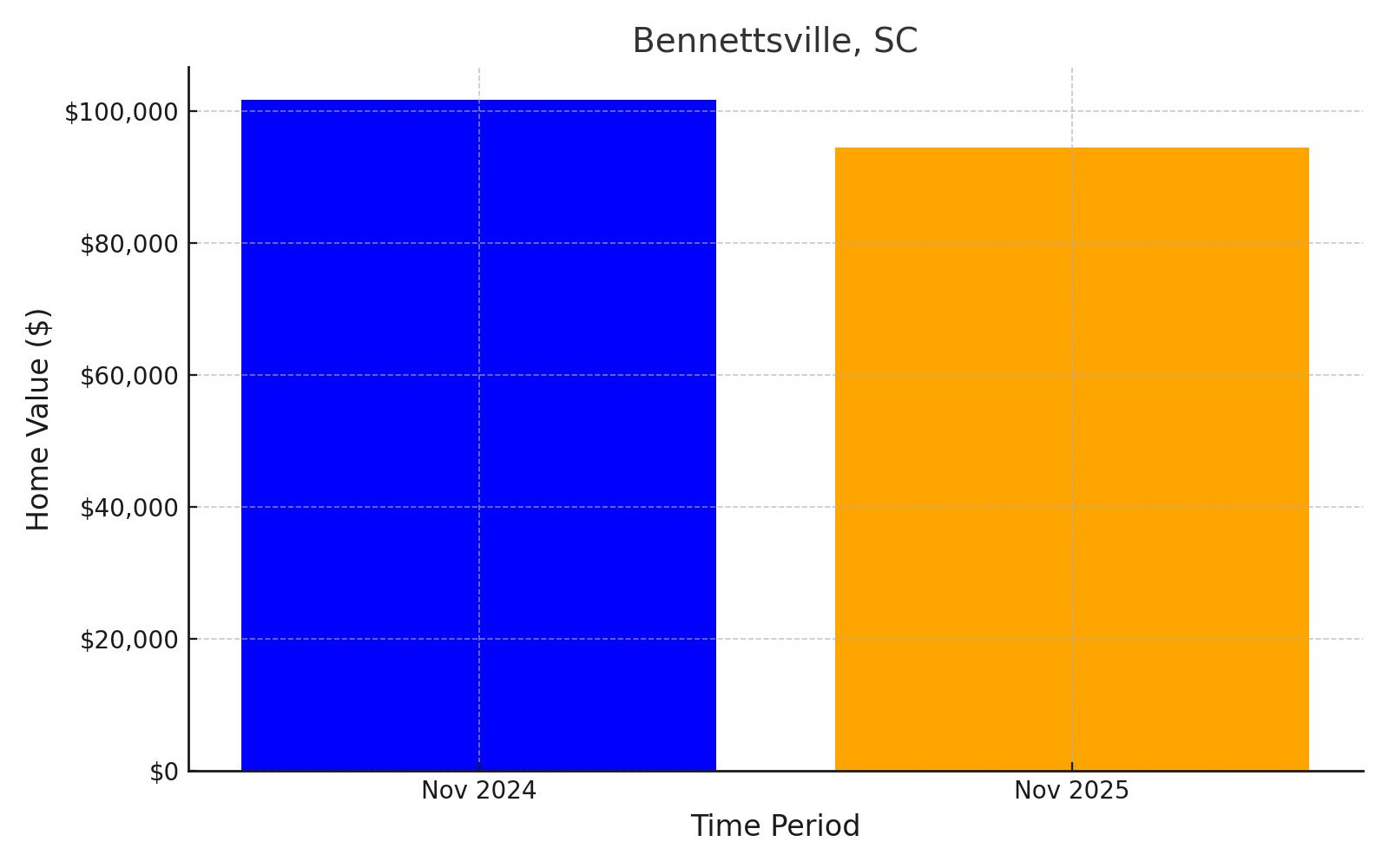

17. Bennettsville, South Carolina

By November 2024, Bennettsville’s home value was $101,651, facing a 7.10% decline to $94,434 by November 2025 – a reduction of $7,217. Manufacturing diversity and agricultural resilience form the city’s economic backbone. Healthcare services and government employment provide additional economic stabilization, creating a robust local ecosystem that adapts to changing market dynamics.

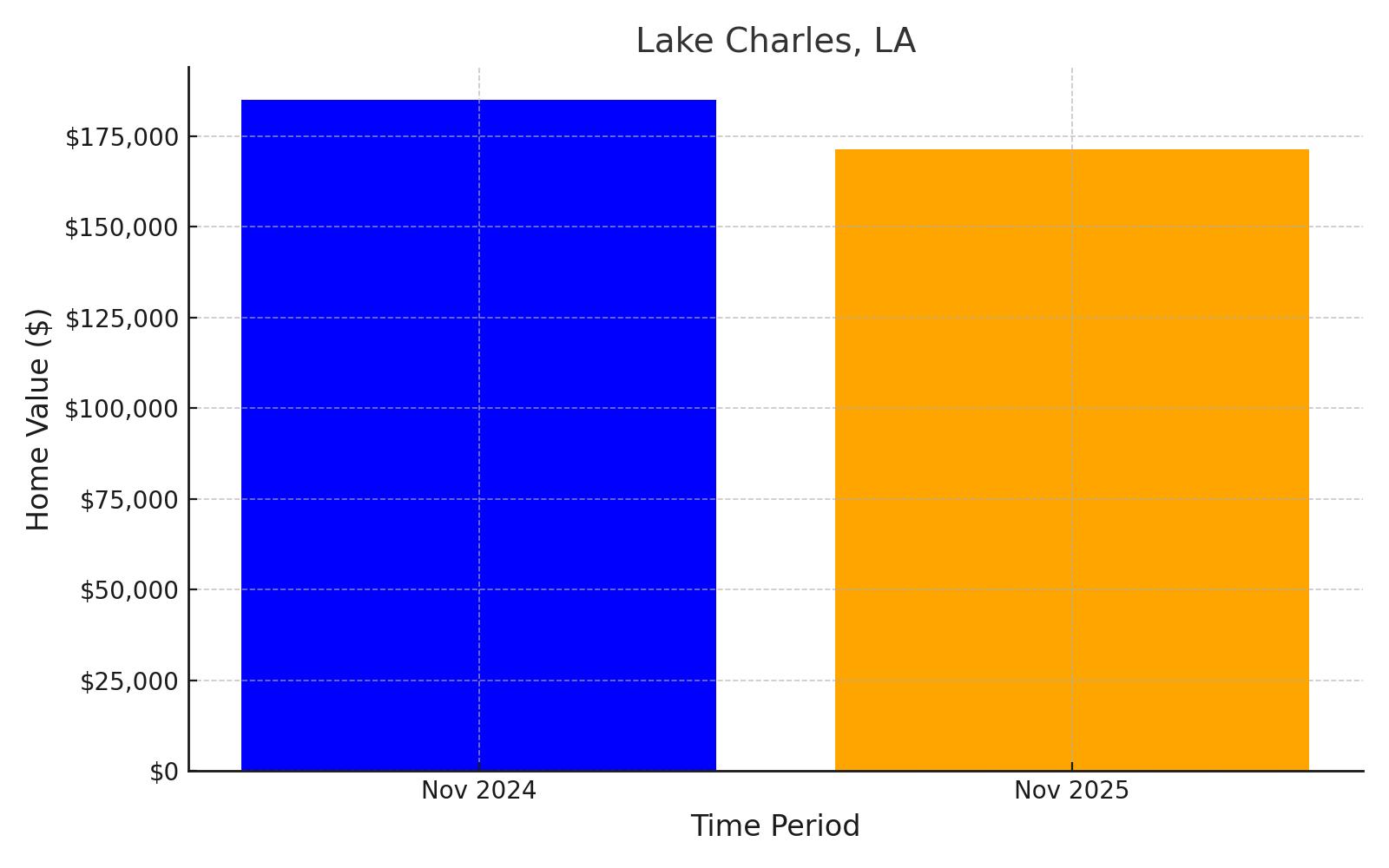

18. Lake Charles, Louisiana

Lake Charles stood at a home value of $184,984 in November 2024, its economic landscape a vibrant tapestry of industrial resilience and strategic diversification. The city’s economic engine hummed with the rhythmic pulse of petrochemical processing, complemented by the dynamic energy of the gaming industry. McNeese State University anchored the educational sector, while healthcare services provided stable employment opportunities. The strategic port facilities and casino industry added layers of economic complexity, creating a multifaceted approach to urban sustainability. Looking forward, economic projections suggested a 7.30% decline in home values, with expectations of reaching $171,480 by November 2025—a potential reduction of $13,504 that reflected the broader economic challenges facing Louisiana’s industrial communities.

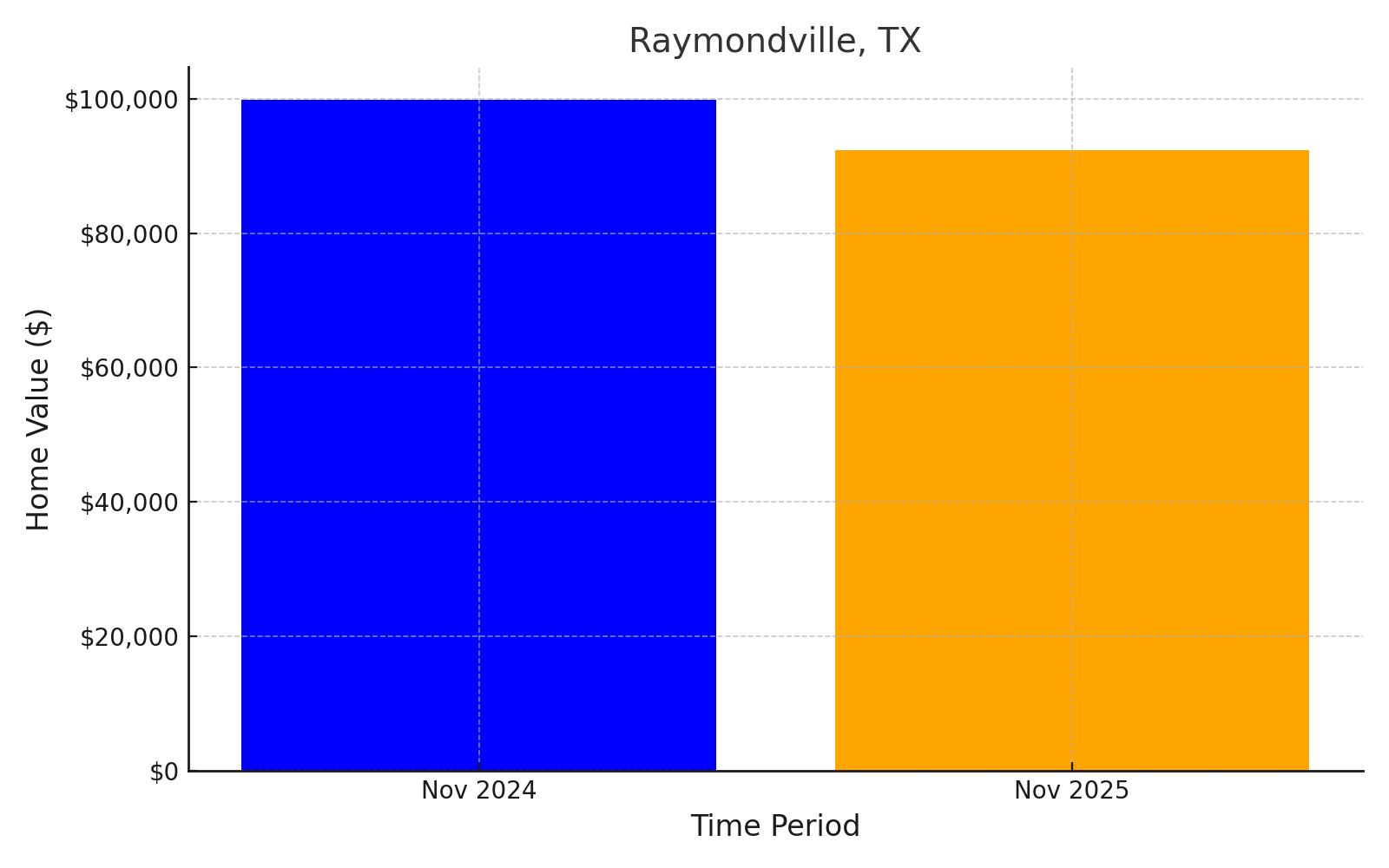

19. Raymondville, Texas

Raymondville had been anchored by a modest home value of $99,792 as of November 2024, with economic prospects shaped by its deeply rooted agricultural landscape. The town’s economic fabric was intricately woven with prison facilities offering stable government positions and healthcare services catering to the local population. Looking ahead, projections suggest a challenging trajectory, with home values expected to dip 7.50% to $92,307 by November 2025, marking a potential loss of $7,485 that reflects the broader economic uncertainties facing rural Texas communities.

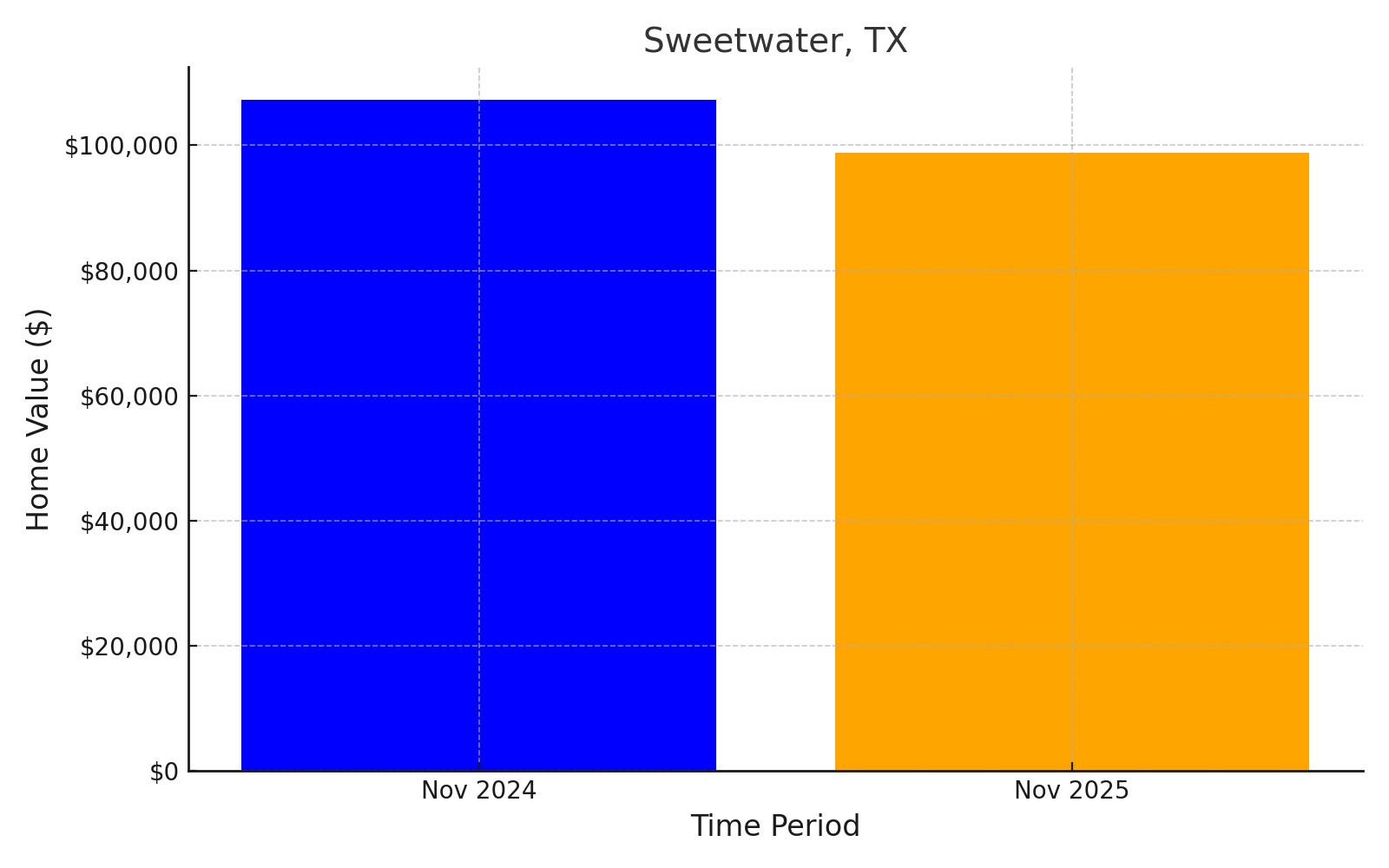

20. Sweetwater, Texas

Sweetwater’s economic landscape in November 2024 revealed a home value of $107,232, embodying a unique blend of traditional ranching and innovative wind energy development. The presence of Texas State Technical College injected vibrancy into the local ecosystem, providing educational pathways and technical training opportunities. As the wind turbines dotting the landscape symbolized progress, economic forecasts pointed to a 7.80% decline, projecting home values would slide to $98,868 by November 2025—a potential reduction of $8,364 that underscores the delicate balance of rural economic transformation.

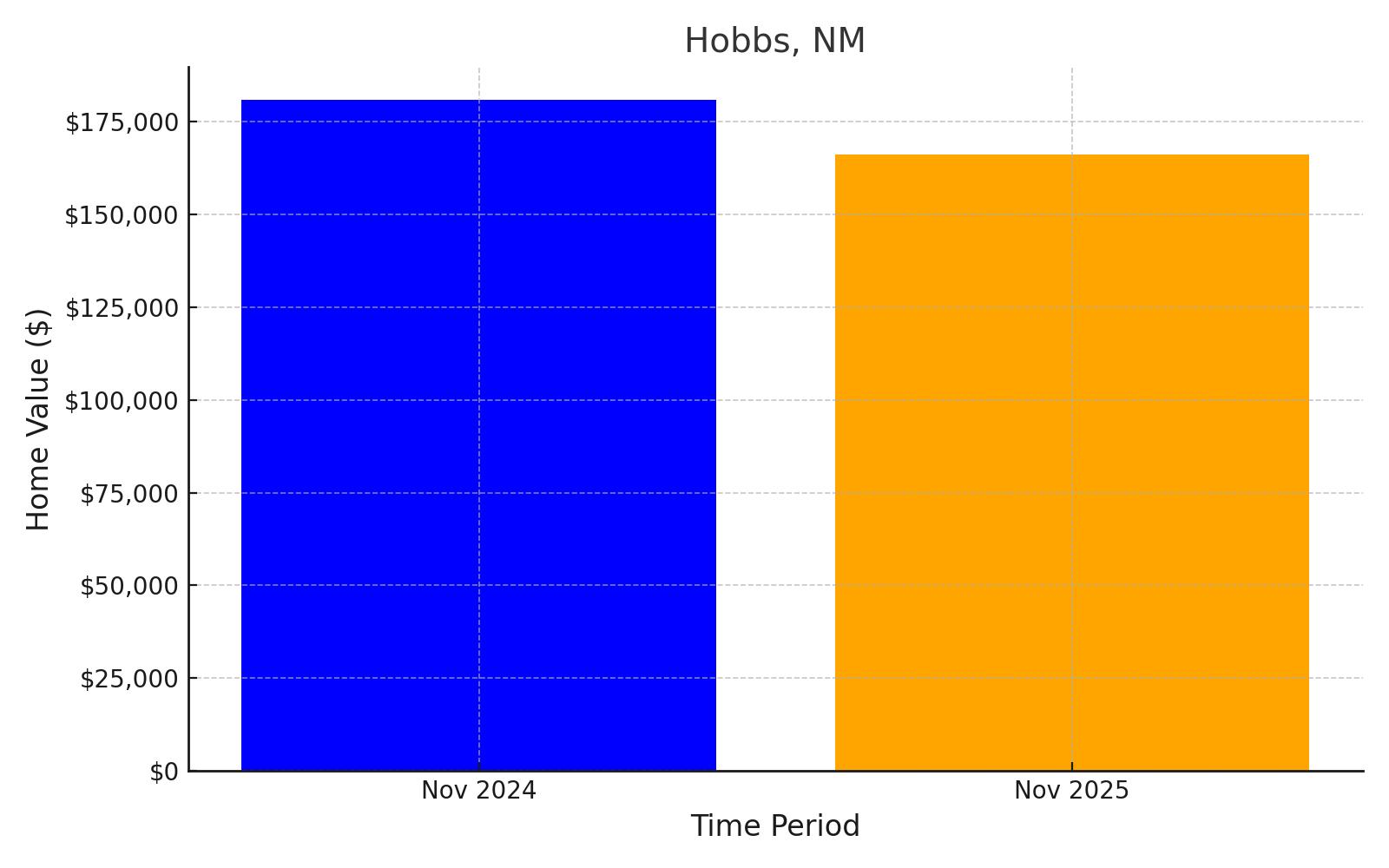

21. Hobbs, New Mexico

Hobbs stood at a home value of $180,770 in November 2024, its economic pulse strongly synchronized with the rhythms of the oil and gas industry. New Mexico Junior College provided an educational counterpoint to the energy sector’s dominance, while healthcare services offered additional economic stabilization. The town’s economic narrative was characterized by volatility and resilience. Projections indicated a potential 8.10% decline, with home values anticipated to descend to $166,128 by November 2025—a reduction of $14,642 that reflected the ongoing challenges in energy-dependent communities.

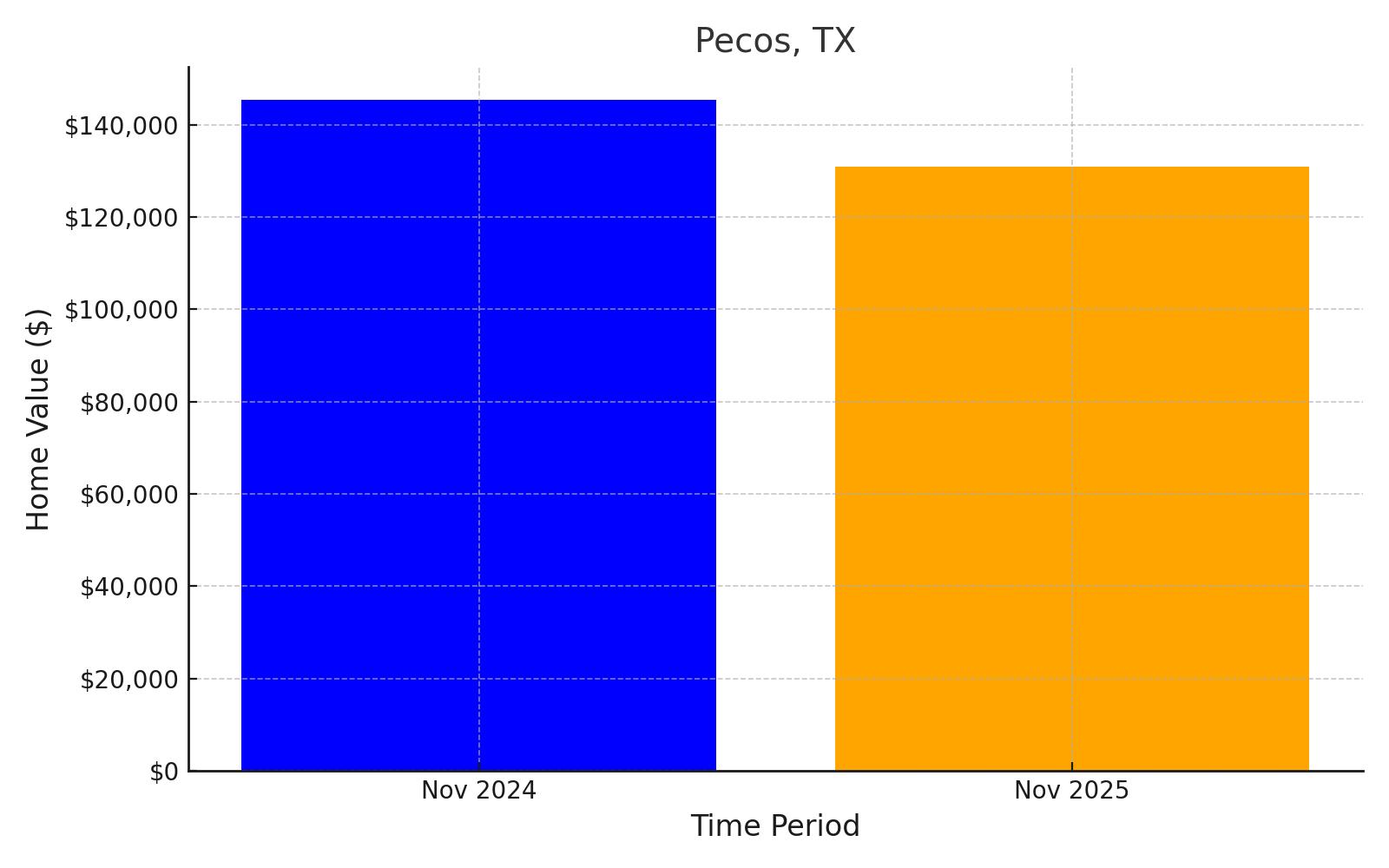

22. Pecos, Texas

In November 2024, Pecos presented a home value of $145,331, its economic identity deeply etched by oil and gas operations and the rich agricultural traditions of the region. The town’s landscape was a testament to adaptability—where cantaloupe fields stretched alongside oil derricks and healthcare facilities served as critical community anchors. Economic forecasts painted a challenging picture, suggesting a dramatic 9.90% decline in home values to $130,943 by November 2025, representing a potential loss of $14,388 that highlighted the economic pressures facing resource-dependent small towns.

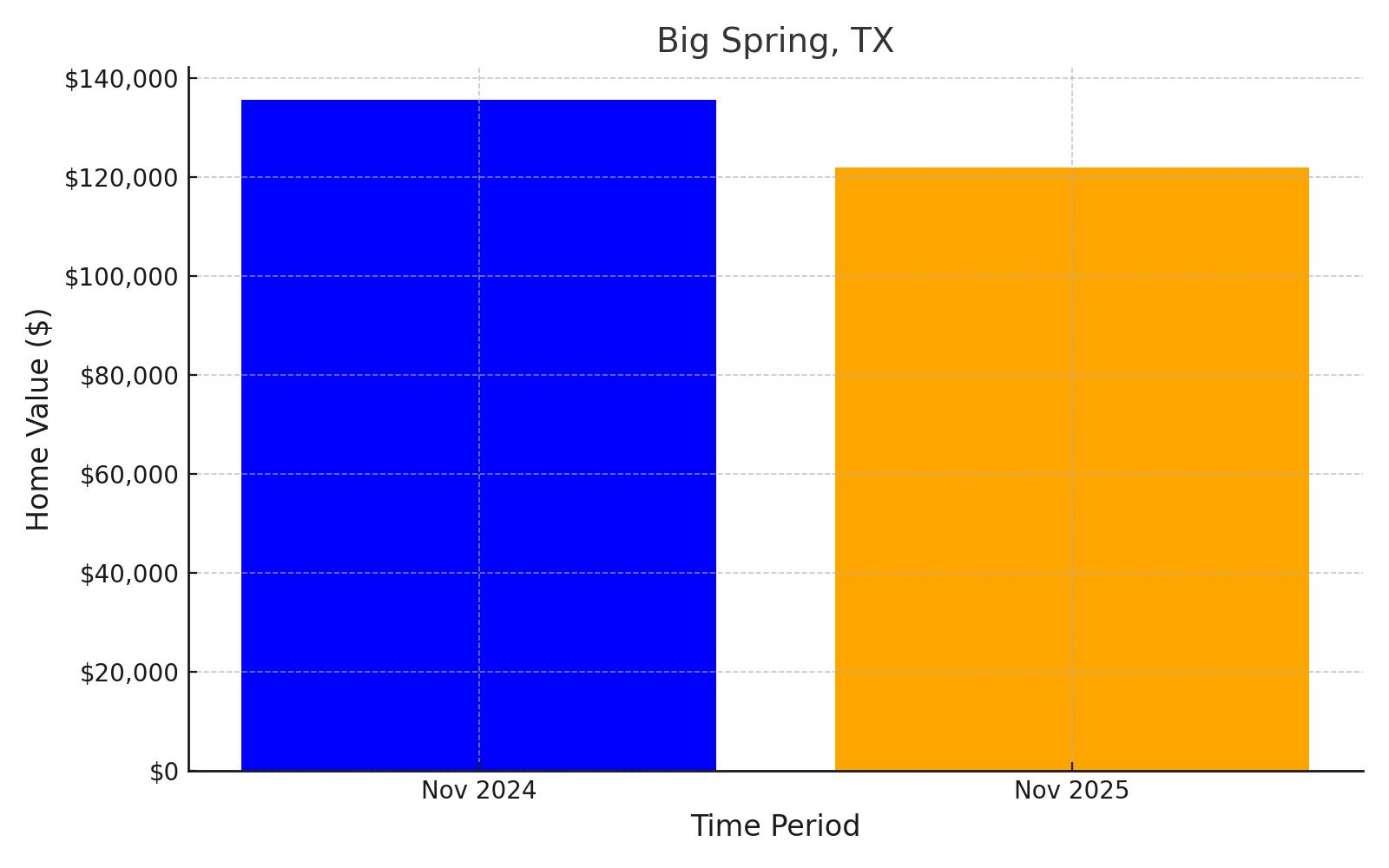

23. Big Spring, Texas

Big Spring’s economic tapestry in November 2024 was valued at $135,509, woven with threads of oil production, healthcare services, and educational institutions. Howard College and the VA Medical Center provided steady employment pillars, while the refining industry and agricultural sectors contributed to a diversified economic resilience. The town faced a projected 10.10% decline in home values, with expectations of reaching $121,823 by November 2025—a potential reduction of $13,686 that underscored the ongoing economic recalibration in Texas’s smaller communities.

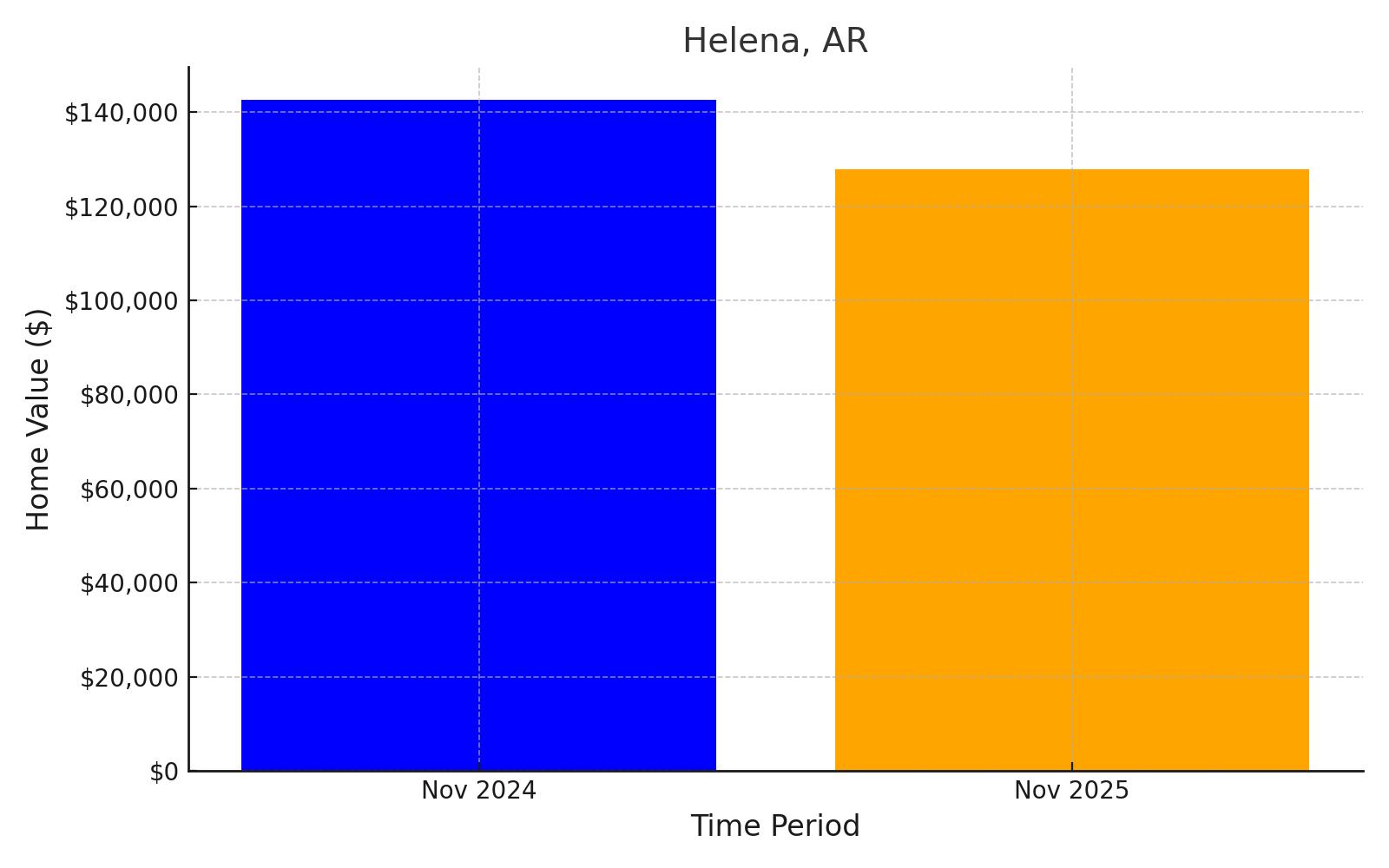

24. Helena, Arkansas

Helena’s economic landscape in November 2024 reflected a home value of $142,567, symbolizing a community in transition from its agricultural roots. The city was reimagining itself through healthcare employment, educational opportunities at Phillips Community College, and a growing tourism sector celebrating its rich Blues heritage. Agricultural influences persisted in the surrounding landscape, even as the city sought new economic pathways. Projections suggested a 10.30% decline in home values, with an anticipated descent to $127,883 by November 2025—a potential reduction of $14,684 that illustrated the complex economic challenges of small-town transformation.

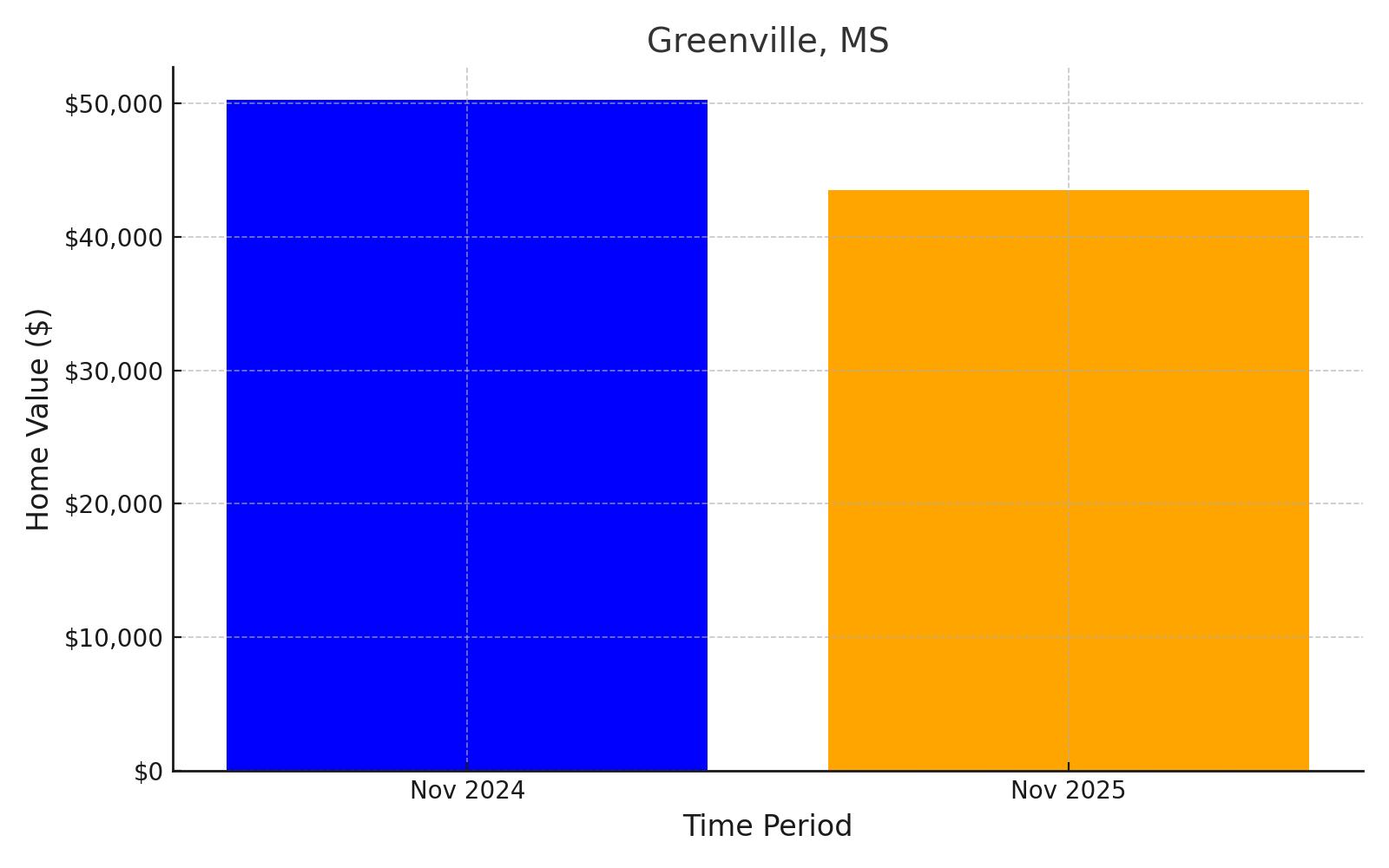

25. Greenville, Mississippi

Positioned along the Mississippi River, Greenville carried the lowest home value in the study at $50,229 in November 2024—a figure that encapsulated both economic challenges and potential. The city’s economic mosaic was composed of healthcare services, educational institutions, casino gaming, and port-related commerce. Manufacturing and agricultural sectors continued to play crucial roles, even as the community navigated complex economic diversification efforts. The most dramatic projected decline of 13.40% suggested home values might fall to $43,498 by November 2025, representing a potential reduction of $6,731 that underscored the resilient spirit of this riverside community.