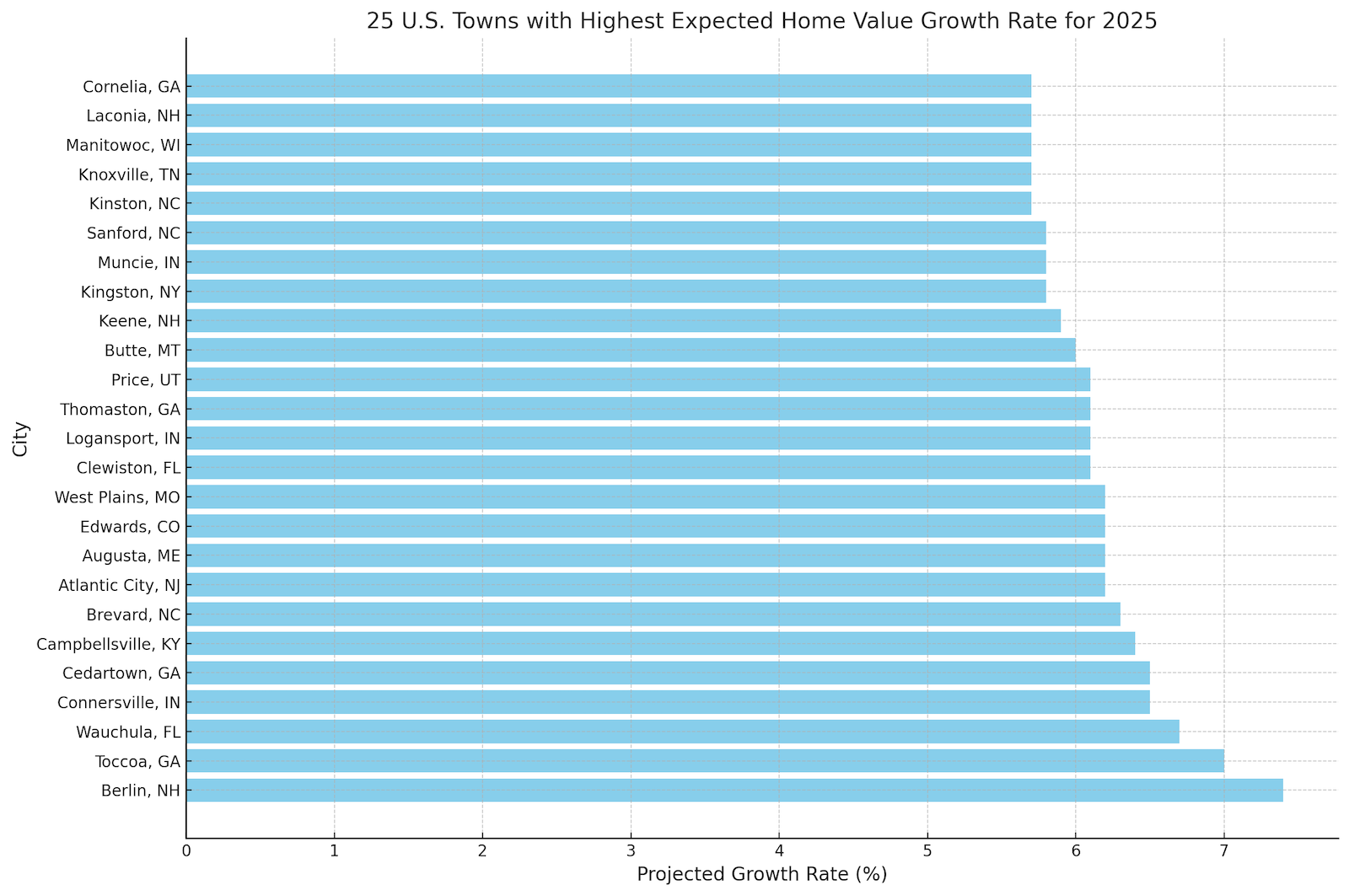

According to Zillow Home Value Index data, small and mid-sized towns across America are showing remarkably strong growth projections for 2025, with projected increases ranging from 5.70% to 7.40% over the next year. Most notably, New England communities are displaying particular strength, with Berlin, New Hampshire leading all markets with a 7.40% projected growth rate and three other New Hampshire towns – Laconia, Keene, and Berlin – appearing in the top 25. The Southeast also demonstrates significant momentum, with Georgia placing four communities in the top growth markets: Toccoa (7.00%), Cedartown (6.50%), Thomaston (6.10%), and Cornelia (5.70%).

The data reveals intriguing patterns about property values and growth potential. Edwards, Colorado stands out with the highest absolute property values at $876,543, projecting to reach $930,889 by November 2025, despite ranking in the middle of the pack for growth rate at 6.20%. Conversely, some of the strongest growth rates appear in markets with more modest home values, such as Logansport, Indiana ($138,765) and Muncie, Indiana ($143,567), suggesting potential opportunities for investment in these more affordable markets. Additionally, college towns show consistent strength, with communities like Campbellsville (Campbellsville University), Muncie (Ball State), and Knoxville (University of Tennessee) all appearing in the top 25.

Overview Chart of Projected Fastest Growing Towns (Home Prices)

Industrial diversity appears to be a common thread among these growth markets, with many transitioning from traditional manufacturing bases to more varied economies. Tourism and healthcare emerge as particularly strong drivers, appearing prominently in at least 20 of the 25 markets. Notably, several communities are successfully leveraging natural assets for economic growth, such as Brevard, North Carolina (Pisgah National Forest), Edwards, Colorado (skiing), and Laconia, New Hampshire (Lakes Region). The presence of state institutions also appears to be a stabilizing factor, with state capitals (Augusta, Maine) and government facilities (Federal Correctional Institution in Berlin, NH) contributing to the economic resilience of these markets.

1. Cornelia, Georgia

Current home values of $258,486 are projected to rise to $273,219 by November 2025, reflecting a 5.70% growth rate. Manufacturing and agriculture continue to be the primary economic drivers in Cornelia. Healthcare services provide stable employment opportunities, while retail trade serves the local population and surrounding communities.

2. Kinston, North Carolina

Housing values currently at $156,321 are expected to reach $165,231 by November 2025, showing a 5.70% growth rate. Manufacturing and agriculture form the foundation of the local economy. Healthcare services provide essential employment, while tourism centered around Civil War history adds to the economic mix.

3. Laconia, New Hampshire

Current home values of $401,544 are projected to increase to $424,432 by November 2025, reflecting a 5.70% growth rate. Tourism in the Lakes Region drives much of the local economy, while healthcare services provide year-round employment. Manufacturing maintains a presence, and retail and services cater to both tourists and residents.

4. Manitowoc, Wisconsin

Housing values currently at $179,843 are expected to reach $190,094 by November 2025, showing a 5.70% growth rate. Manufacturing, particularly in cranes and food processing, drives the local economy. The maritime industry maintains its historical importance, while healthcare services and tourism related to Lake Michigan provide additional economic opportunities.

5. Knoxville, Tennessee

Current home values of $315,678 are projected to rise to $333,672 by November 2025, reflecting a 5.70% growth rate. The University of Tennessee and Oak Ridge National Laboratory form the cornerstone of the local economy. Healthcare services provide significant employment, while tourism adds to the economic diversity of the region.

6. Sanford, North Carolina

Housing values currently at $276,432 are expected to reach $292,465 by November 2025, showing a 5.80% growth rate. Manufacturing leads the local economy, with particular strength in brick production and biotechnology. Healthcare services and education provide stable employment, while retail and services support the local population.

7. Muncie, Indiana

Current home values of $143,567 are projected to increase to $151,894 by November 2025, reflecting a 5.80% growth rate. Ball State University serves as the primary economic driver, while healthcare services provide significant employment. Manufacturing maintains a presence in the local economy, and retail trade serves both the student and permanent population.

8. Kingston, New York

Housing values currently at $334,567 are expected to reach $353,972 by November 2025, showing a 5.80% growth rate. The town’s economy has evolved to embrace healthcare services and technology sectors. The creative industries have found a home here, while tourism and education contribute to a diverse economic base.

9. Keene, New Hampshire

Current home values of $321,789 are projected to rise to $340,774 by November 2025, reflecting a 5.90% growth rate. Keene State College serves as a major economic driver, while manufacturing maintains a strong presence. Healthcare services provide significant employment, and the insurance and financial services sectors continue to grow.

10. Butte, Montana

Housing values in Butte currently stand at $287,654 and are expected to reach $304,913 by November 2025, showing a 6.00% growth rate. Mining continues to influence the local economy, while tourism focused on historical sites has grown in importance. Montana Technological University provides educational opportunities and employment, and healthcare services serve the broader region.

11. Price, Utah

Current home values of $298,765 are projected to increase to $316,990 by November 2025, reflecting a 6.10% growth rate. The mining and energy sectors continue to be major economic drivers, while Utah State University Eastern provides educational opportunities and employment. Healthcare services serve the region, and tourism centered around Nine Mile Canyon adds to the economic mix.

12. Thomaston, Georgia

Housing values currently at $187,654 are expected to reach $199,101 by November 2025, showing a 6.10% growth rate. The town’s economy remains strongly tied to manufacturing, particularly in textiles and automotive sectors. Healthcare services and education provide stable employment, while retail trade serves the local community.

13. Logansport, Indiana

Current home values of $138,765 are projected to rise to $147,230 by November 2025, reflecting a 6.10% growth rate. Manufacturing remains the backbone of Logansport’s economy, while agriculture continues to play a vital role. Healthcare services provide essential employment, and the transportation and logistics sector has grown in importance.

14. Clewiston, Florida

Housing values in Clewiston currently stand at $223,456 and are projected to reach $237,087 by November 2025, showing a 6.10% growth rate. Known as “America’s Sweetest Town,” the local economy centers around the sugar industry, with U.S. Sugar Corporation being a major employer. Agriculture and food processing continue to dominate, while tourism related to Lake Okeechobee provides additional economic opportunities.

15. West Plains, Missouri

Current home values of $167,890 are expected to increase to $178,299 by November 2025, reflecting a 6.20% growth rate. Agriculture remains a cornerstone of the local economy, while Missouri State University-West Plains provides educational opportunities and stable employment. Healthcare services and manufacturing contribute to a diverse economic base.

16. Edwards, Colorado

With the highest property values in our study at $876,543, Edwards is projected to see values rise to $930,889 by November 2025, showing a 6.20% growth rate. The town’s economy is heavily influenced by tourism, particularly the skiing and mountain recreation industry. Luxury real estate development continues to thrive, while hospitality services and high-end retail and restaurants cater to both visitors and wealthy residents.

17. Augusta, Maine

Augusta’s housing market shows current values of $267,890, projected to reach $284,499 by November 2025, with a 6.20% growth rate. As the state capital, government employment forms the backbone of the local economy. MaineGeneral Medical Center leads the healthcare sector, while education provides additional employment opportunities. The finance and insurance sectors add diversity to the economic landscape.

18. Atlantic City, New Jersey

Current home values of $215,336 are expected to increase to $228,687 by November 2025, reflecting a 6.20% growth rate. The city’s economy continues to be dominated by gaming and casino operations, complemented by a robust tourism and hospitality sector. The convention business brings significant visitor traffic, while healthcare services provide stable employment opportunities for residents.

19. Brevard, North Carolina

Housing values in Brevard currently sit at $367,890 and are projected to reach $391,067 by November 2025, showing a 6.30% growth rate. The town’s economy benefits greatly from tourism, drawing visitors to the Pisgah National Forest. Brevard College adds an important educational dimension to the community. The town has developed a strong arts and music industry, while outdoor recreation activities provide year-round economic opportunities.

20. Campbellsville, Kentucky

Current home values of $178,654 are projected to rise to $190,088 by November 2025, reflecting a 6.40% growth rate. Campbellsville University serves as a major economic driver and cultural center for the community. The town has successfully attracted modern industry, including an Amazon fulfillment facility, while maintaining its manufacturing base. Healthcare services provide stable employment, and the education sector continues to grow in importance to the local economy.

21. Connersville, Indiana

Home values in Connersville currently stand at $147,843 and are expected to increase to $157,453 by November 2025, showing a 6.50% growth rate. The town’s economic foundation remains firmly in manufacturing, particularly in automotive and industrial sectors. Healthcare services provide significant employment opportunities, while agriculture continues to play an important role in the local economy. The retail trade sector serves the local community and surrounding areas.

22. Cedartown, Georgia

Cedartown’s housing market shows current values of $195,588, projected to reach $208,301 by November 2025, with a growth rate of 6.50%. The town’s economy is anchored by manufacturing, particularly in automotive parts and textiles. Polk Medical Center serves as a crucial healthcare provider and major employer. The education sector and retail services round out the economic landscape, providing essential services to the community.

23. Wauchula, Florida

Current home values in Wauchula are $218,530 as of November 2024, with projections indicating an increase to $233,172 by November 2025, representing a 6.70% growth rate. The local economy is deeply rooted in agriculture, with citrus farming and cattle ranching playing central roles. Food processing facilities complement the agricultural sector, while healthcare services and retail businesses serve the local population. The town’s agricultural heritage continues to shape its economic identity while adapting to modern market demands.

24. Toccoa, Georgia

Home values in Toccoa stand at $212,675 as of November 2024 and are expected to reach $227,562 by November 2025, showing a robust growth rate of 7.00%. The town maintains a diverse economic base centered around manufacturing, with particular strength in automotive parts and textiles. Toccoa Falls College serves as a significant educational institution and employer. The healthcare sector provides essential services and employment, while a strong retail trade sector serves both locals and visitors.

25. Berlin, New Hampshire

With a current home value of $189,691 as of November 2024, Berlin is projected to see values rise to $203,728 by November 2025, reflecting a strong growth rate of 7.40%. Once dominated by paper mills, Berlin has successfully diversified its economy. The town’s economic foundation now rests on healthcare, anchored by Androscoggin Valley Hospital, while tourism has become increasingly important due to its proximity to the White Mountain National Forest. Small manufacturing operations and the Federal Correctional Institution provide stable employment bases for the community.