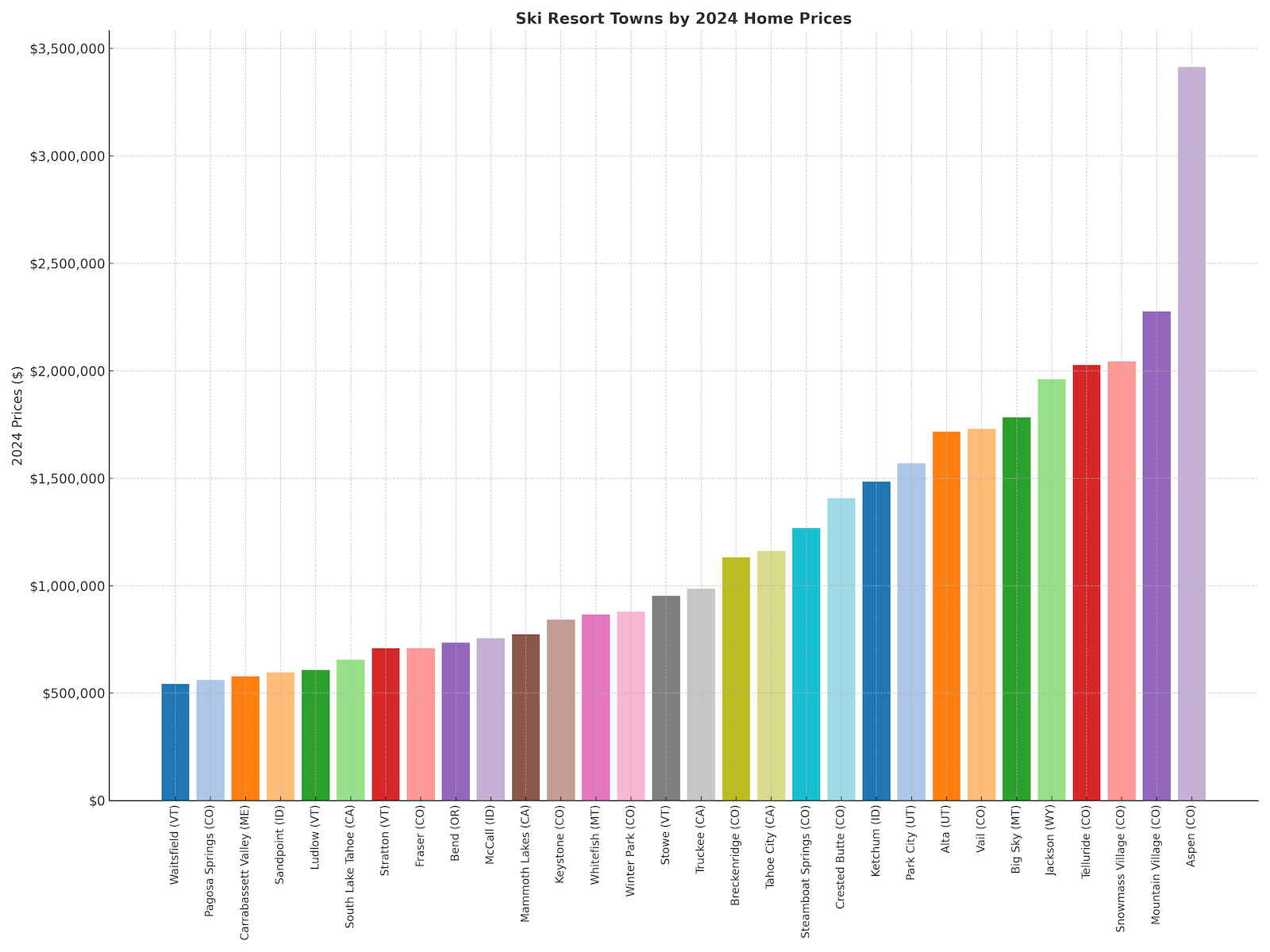

According to the Zillow Home Value Index data as of November 30, 2024, America’s premier ski resort towns showcase significant value differentiation, with a median home value of $943,844 among the top 30 destinations. The mean home value reaches $1,232,995, with the mathematical average also at $1,232,995, indicating a right-skewed distribution driven by ultra-premium markets like Aspen at $3.4 million and Mountain Village at $2.3 million.

The price spectrum ranges dramatically from Waitsfield, Vermont’s $543,511 to Aspen’s $3,413,108, with Colorado maintaining its dominance by claiming eleven of the top 30 spots, including four of the five most expensive towns. The Rocky Mountain region’s prominence extends beyond Colorado, with Montana, Wyoming, and Utah together accounting for five spots in the top 10, while Idaho places three towns on the list, demonstrating the region’s stronghold on high-value winter sports destinations.

The Eastern ski markets show comparatively modest valuations, with Vermont’s Stowe leading the region at $953,340, while California’s Lake Tahoe region places three towns on the list with values ranging from $655,666 to $1,162,250. This geographic value distribution reflects not only skiing infrastructure and snow quality but also accessibility to major metropolitan areas and the presence of year-round amenities that support premium valuations.

Home prices chart for the 30 most expensive U.S. ski resort towns

Notable observations about this elite group of ski towns reveal several compelling trends. Colorado’s dominance is particularly striking, with its towns representing more than one-third of the list and claiming both the highest average prices and the greatest concentration of ultra-luxury markets. The data shows remarkable appreciation rates over the nine-year period from 2015 to 2024, with Fraser, Colorado leading at 186.3%, followed by McCall, Idaho at 175.7% and Winter Park, Colorado at 171.9% – all significantly outpacing national real estate appreciation rates.

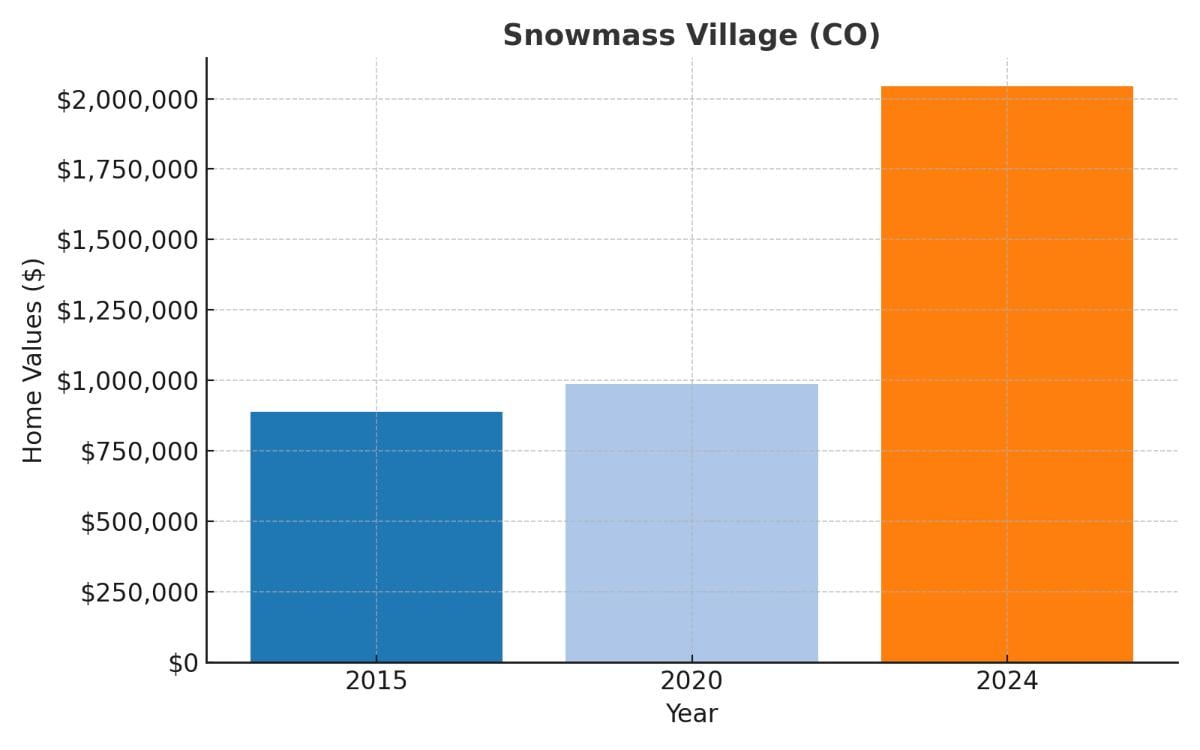

The impact of the post-COVID market is evident in the dramatic acceleration of values between 2020 and 2024, with some towns like Mountain Village and Snowmass Village seeing their values more than double during this period. Geographic isolation appears to command a premium, with some remote locations like Telluride ($2.0M) and Mountain Village ($2.3M) outperforming more accessible resorts, suggesting exclusivity and limited inventory outweigh convenience for luxury buyers.

The data also reveals fascinating regional patterns and market dynamics. A clear hierarchy exists within each state’s resort offerings, exemplified by Colorado’s progression from Aspen to Pagosa Springs, and Vermont’s range from Stowe to Waitsfield. The Lake Tahoe region demonstrates the premium for lakefront locations, with Tahoe City’s values ($1.16M) significantly exceeding those of South Lake Tahoe ($656K). Idaho’s emergence as a luxury ski destination is evident with Ketchum, McCall, and Sandpoint all showing dramatic appreciation rates, likely driven by the state’s growing appeal to remote workers and luxury buyers. Limited inventory in many of these markets, particularly in historic towns with geographic constraints, appears to be a significant factor in maintaining premium values. Additionally, the proximity to national parks and public lands adds value, as seen in the high valuations of Jackson (near Grand Teton) and Big Sky (near Yellowstone), suggesting that summer recreation opportunities are increasingly critical to maintaining premium valuations in the ski resort market.

FYI, there are some towns for which there is no historical data.

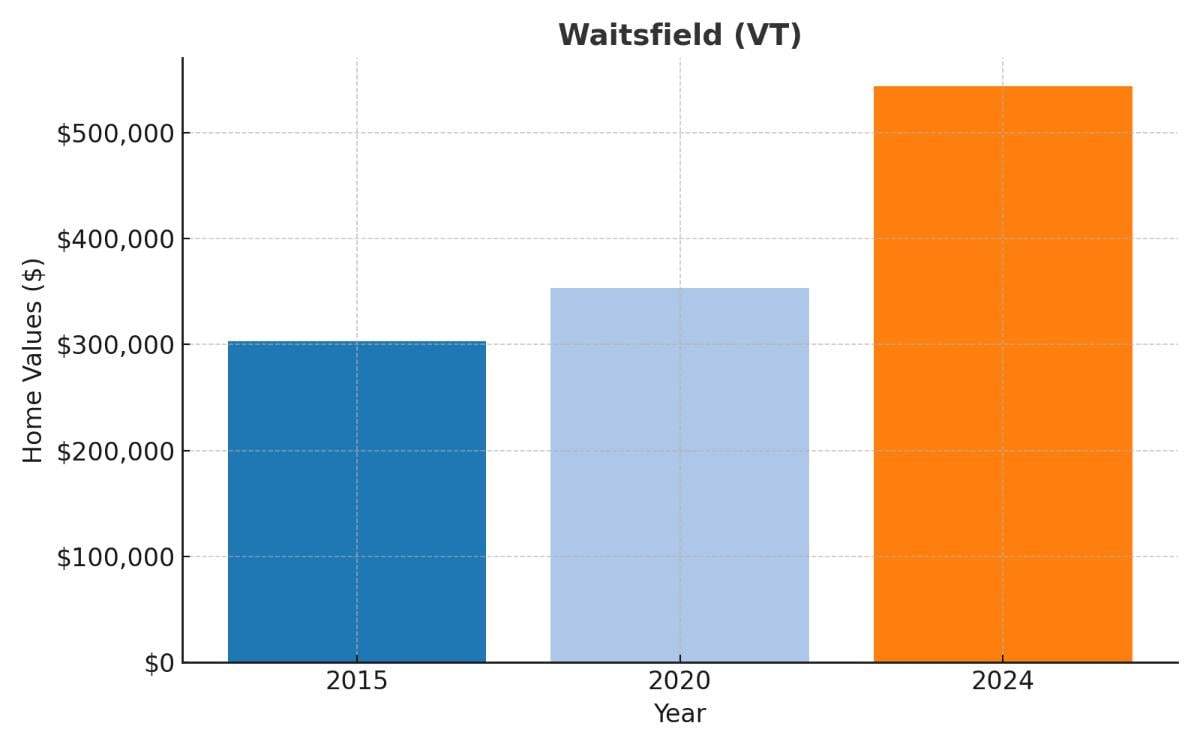

#30. Waitsfield (VT)

Situated in Vermont’s Mad River Valley, Waitsfield serves as the gateway to Sugarbush Resort and Mad River Glen. Home values reached $543,511 in 2024, up from $352,929 in 2020 and $303,212 in 2015, showing a 79.3% nine-year appreciation. Despite having the lowest values among our top 30, its authentic New England character and proximity to both Burlington and Boston maintain steady growth.

#29. Pagosa Springs (CO)

Located in southwest Colorado and known for its natural hot springs, Pagosa Springs provides access to Wolf Creek Ski Area, famous for receiving the most snow in Colorado. Property values climbed to $562,120 in 2024, from $366,013 in 2020 and $252,200 in 2015, representing a 122.9% increase. The combination of skiing and geothermal attractions drives year-round appeal.

#28. Carrabassett Valley (ME)

Home to Sugarloaf Mountain, Maine’s largest ski resort, Carrabassett Valley sits in the state’s western mountains. Values have risen to $578,981 in 2024, up from $352,331 in 2020 and $251,052 in 2015, showing a 130.6% gain. Its position as New England’s only lift-served above-treeline skiing destination adds unique value.

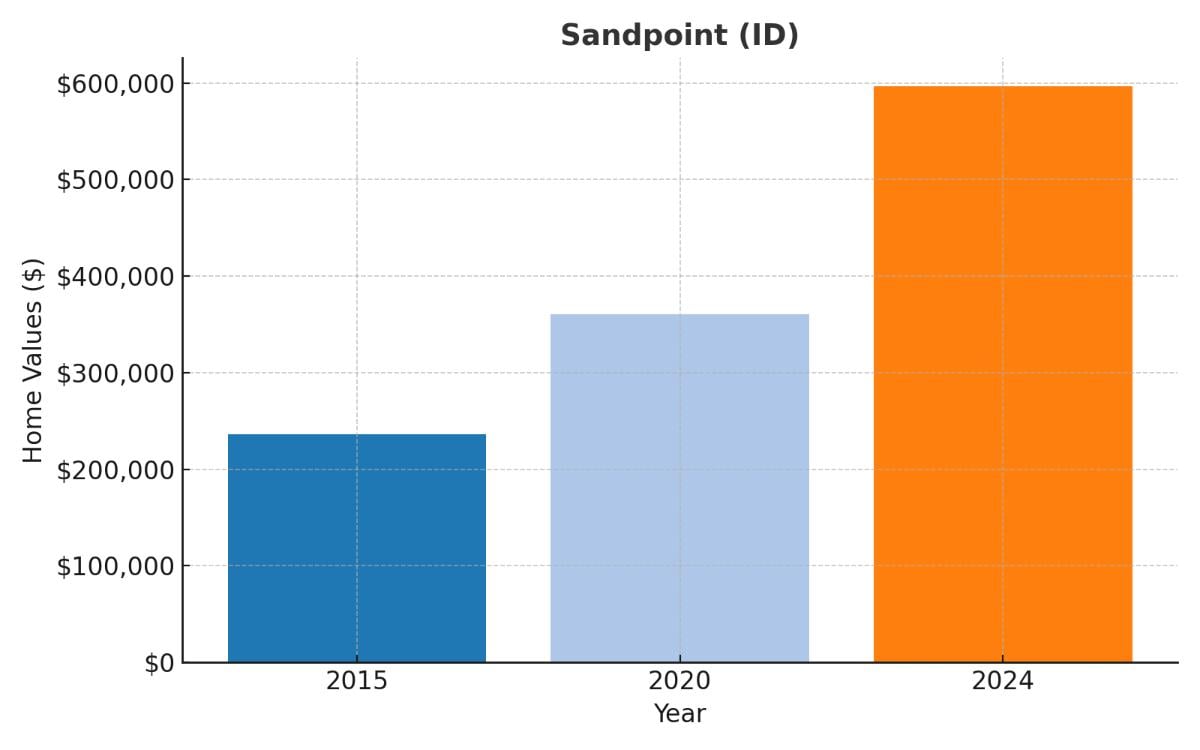

#27. Sandpoint (ID)

Nestled on Lake Pend Oreille and home to Schweitzer Mountain Resort, Sandpoint combines lakefront living with alpine recreation. Values reached $596,578 in 2024, increasing from $360,615 in 2020 and $236,604 in 2015 – a substantial 152.1% appreciation. The town’s natural beauty and growing reputation as an affordable alternative to other Western resort towns drives steady growth.

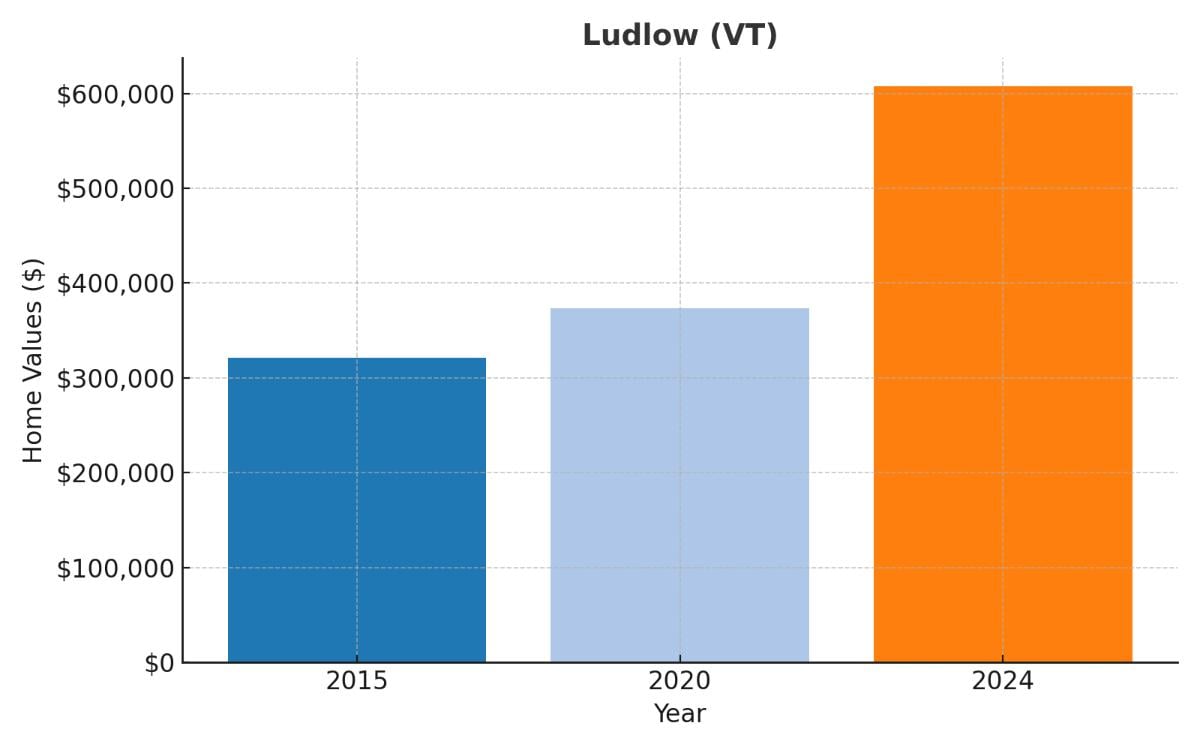

#26. Ludlow (VT)

Host to Okemo Mountain Resort, Ludlow offers premier Eastern skiing just four hours from Boston. Property values have climbed to $607,514 in 2024, up from $373,295 in 2020 and $321,031 in 2015, marking an 89.2% increase. Its accessibility to major Northeast population centers supports consistent appreciation.

#25. South Lake Tahoe (CA)

Straddling the California-Nevada border at Lake Tahoe’s southern end, this resort city provides access to Heavenly Mountain Resort. Values reached $655,666 in 2024, rising from $475,193 in 2020 and $367,017 in 2015, showing a 78.6% gain. Its unique position offering both lake activities and world-class skiing maintains steady growth despite having the lowest appreciation rate among our top 30.

#24. Stratton (VT)

Home to Stratton Mountain Resort, Vermont’s highest peak south of Killington, this resort community pairs luxury amenities with authentic Vermont character. Values climbed to $709,175 in 2024, from $417,365 in 2020 and $342,411 in 2015, representing a 107.1% increase. Its popularity among New York City residents helps maintain premium valuations.

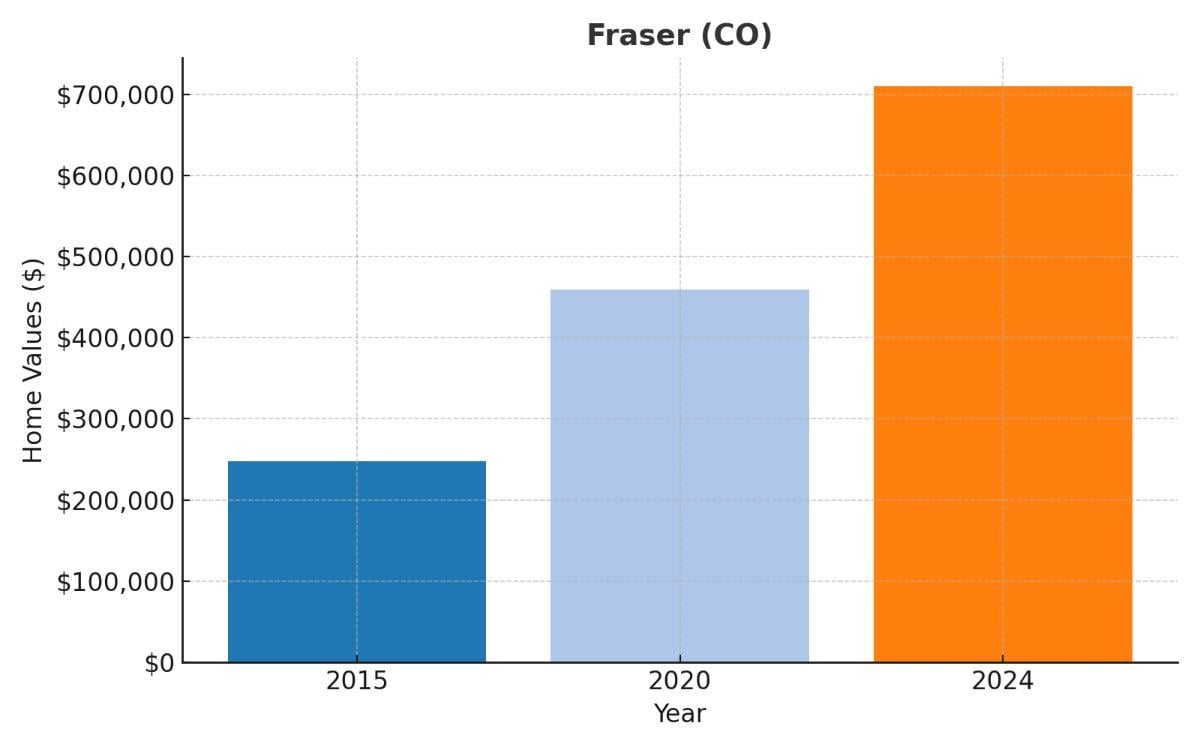

#23. Fraser (CO)

Located just east of Winter Park Resort and known as “The Icebox of the Nation,” Fraser offers more affordable access to world-class Colorado skiing. The market has surged to $709,668 in 2024, up from $459,004 in 2020 and $247,842 in 2015 – marking the highest appreciation rate among all towns at 186.3%. Its proximity to Denver and relative affordability drive strong growth.

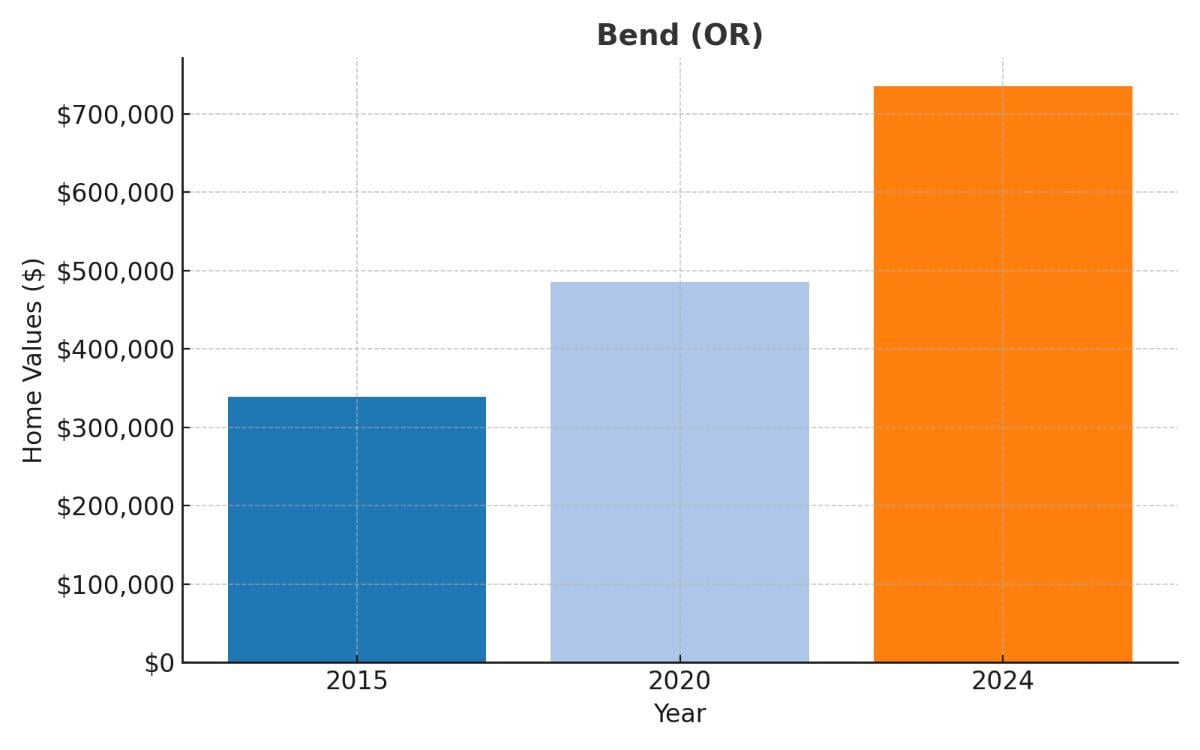

#22. Bend (OR)

Situated in central Oregon with access to Mount Bachelor, Bend combines outdoor recreation with urban amenities. Values reached $734,929 in 2024, increasing from $485,725 in 2020 and $338,906 in 2015, showing a 116.9% appreciation. Its growing tech industry and year-round recreation opportunities support consistent value growth.

#21. McCall (ID)

Set on the shores of Payette Lake and home to Brundage Mountain Resort, McCall offers a combination of lake and mountain recreation. Property values have risen to $755,100 in 2024, from $438,739 in 2020 and $273,928 in 2015 – an impressive 175.7% increase. Its emerging status as an alternative to more expensive Western resort towns drives strong appreciation.

#20. Mammoth Lakes (CA)

Situated in California’s Eastern Sierra Nevada Mountains, Mammoth Lakes provides access to one of North America’s largest ski resorts. Values reached $774,230 in 2024, up from $526,898 in 2020 and $360,764 in 2015, showing a 114.6% gain. Its proximity to Southern California and extended ski season maintain steady growth.

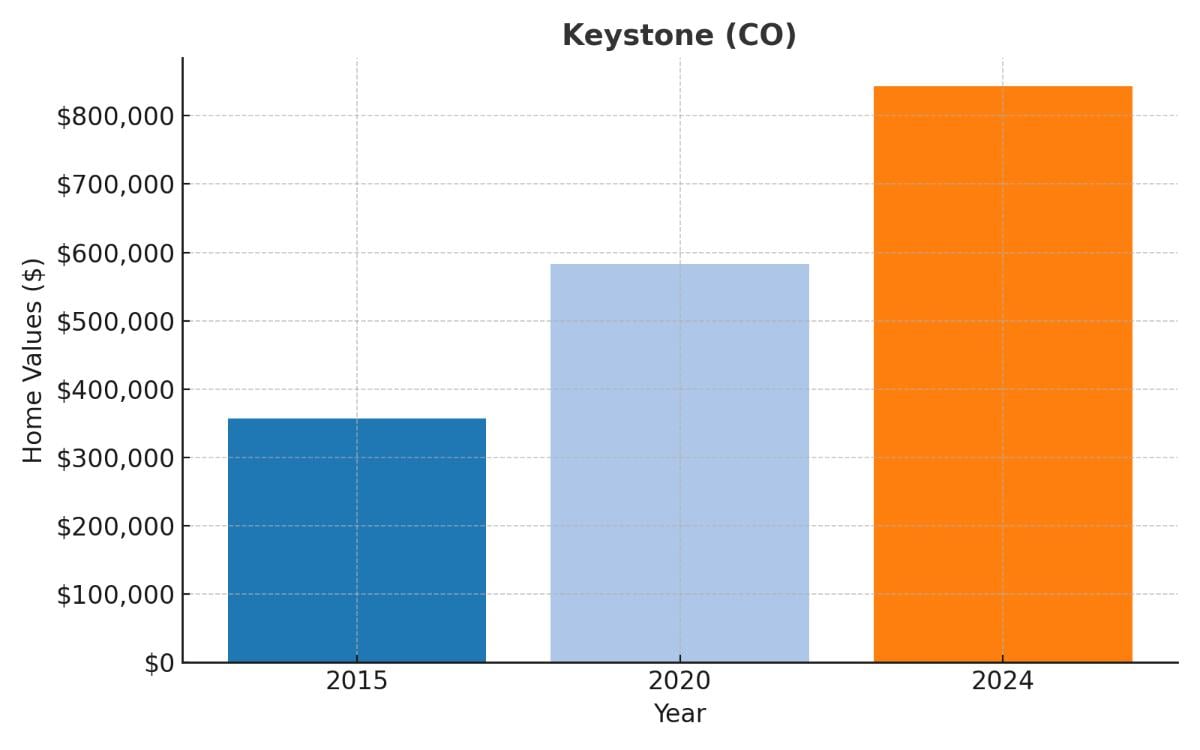

#19. Keystone (CO)

Located 75 miles west of Denver, Keystone offers night skiing and extensive terrain across three mountains. The market has appreciated to $843,077 in 2024, rising from $583,528 in 2020 and $356,906 in 2015, marking a 136.2% increase. Its position as one of the closest major resorts to Denver International Airport supports strong valuations.

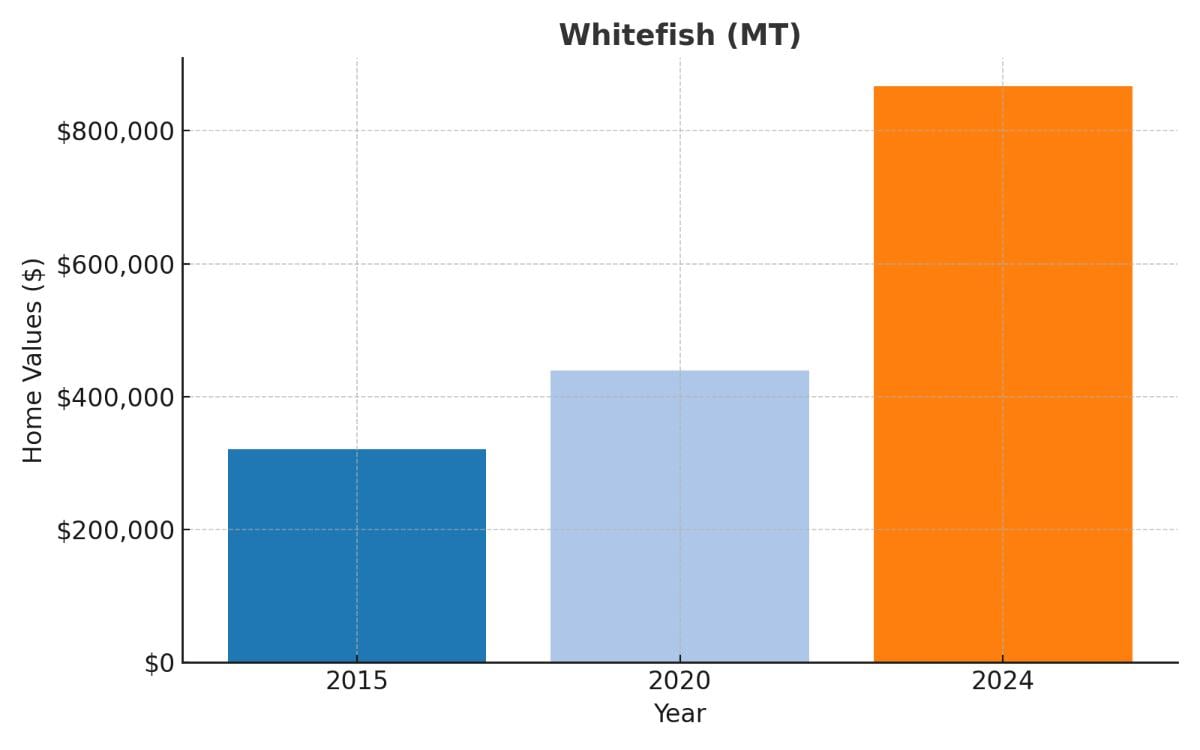

#18. Whitefish (MT)

Nestled in Montana’s Flathead Valley near Glacier National Park, Whitefish combines small-town charm with world-class skiing. Values have climbed to $866,948 in 2024, from $439,469 in 2020 and $320,738 in 2015 – a remarkable 170.3% appreciation. Its growing reputation as a luxury destination and proximity to natural attractions drive premium valuations.

#17. Winter Park (CO)

As the closest major ski resort to Denver, Winter Park benefits from easy access via car or ski train. Property values reached $879,100 in 2024, up from $566,048 in 2020 and $323,364 in 2015, showing an impressive 171.9% gain. Its accessibility and consistent snow conditions support strong market performance.

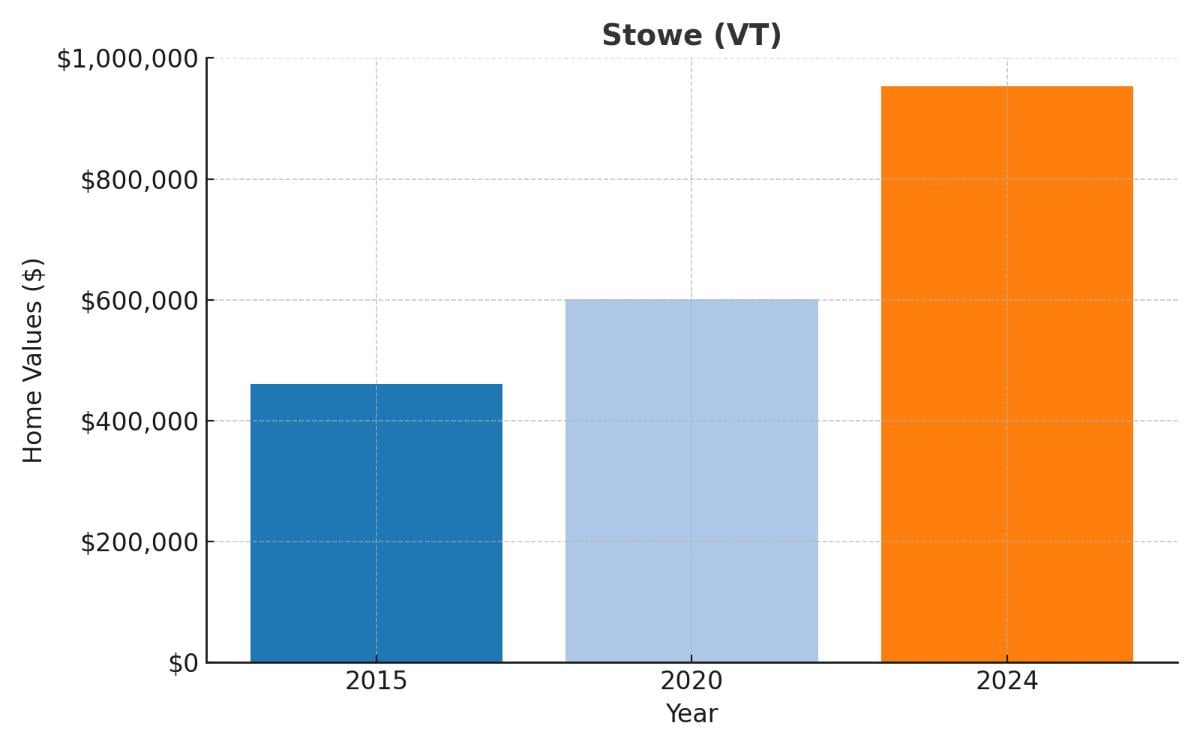

#16. Stowe (VT)

Known as “The Ski Capital of the East,” Stowe combines luxury amenities with classic New England character at the base of Mount Mansfield. Values have risen to $953,340 in 2024, from $600,604 in 2020 and $460,218 in 2015, representing a 107.1% increase. Its status as the East’s premier ski destination maintains premium valuations.

#15. Truckee (CA)

This historic railroad town, located near several Lake Tahoe ski resorts, serves as a hub for regional mountain recreation. The market has strengthened to $986,348 in 2024, up from $651,968 in 2020 and $527,801 in 2015, showing an 86.9% appreciation. Its position as a gateway to multiple ski areas drives consistent growth.

#14. Breckenridge (CO)

Set in a Victorian-era mining town at 9,600 feet, Breckenridge combines historic charm with extensive ski terrain. Values reached $1,132,285 in 2024, rising from $833,347 in 2020 and $541,803 in 2015, marking a 109.0% increase. Its walkable downtown and preserved character attract premium buyers.

#13. Tahoe City (CA)

Positioned on Lake Tahoe’s north shore, Tahoe City offers access to numerous ski resorts and year-round lake activities. The market has appreciated to $1,162,250 in 2024, from $746,893 in 2020 and $610,645 in 2015, showing a 90.3% gain. Its lakefront location commands significant premiums.

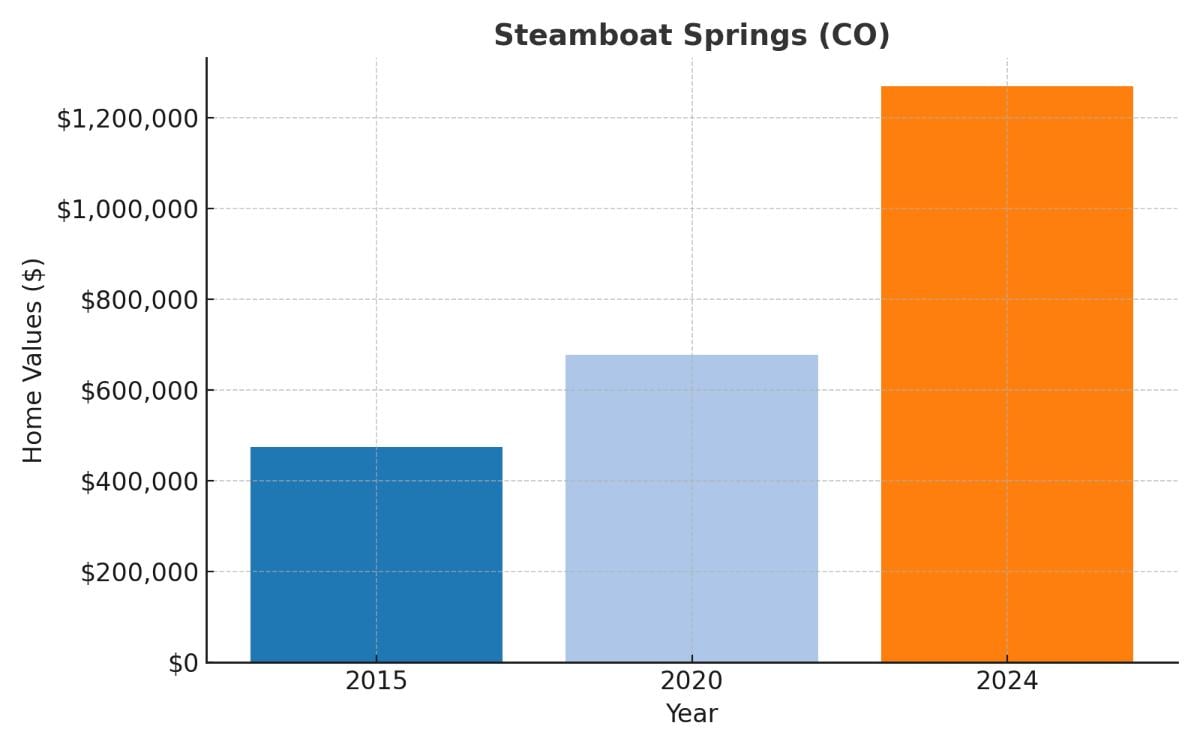

#12. Steamboat Springs (CO)

Known for its champagne powder and western heritage, Steamboat Springs combines authentic ranch culture with luxury amenities. Values have climbed to $1,268,874 in 2024, from $676,798 in 2020 and $473,963 in 2015 – a substantial 167.7% increase. Its unique character and growing luxury market drive strong appreciation.

#11. Crested Butte (CO)

This remote former mining town maintains its authentic character while offering extensive extreme skiing terrain. Property values reached $1,407,310 in 2024, up from $882,850 in 2020 and $546,427 in 2015, showing a remarkable 157.5% gain. Its intentionally limited development and preserved historic downtown support premium valuations.

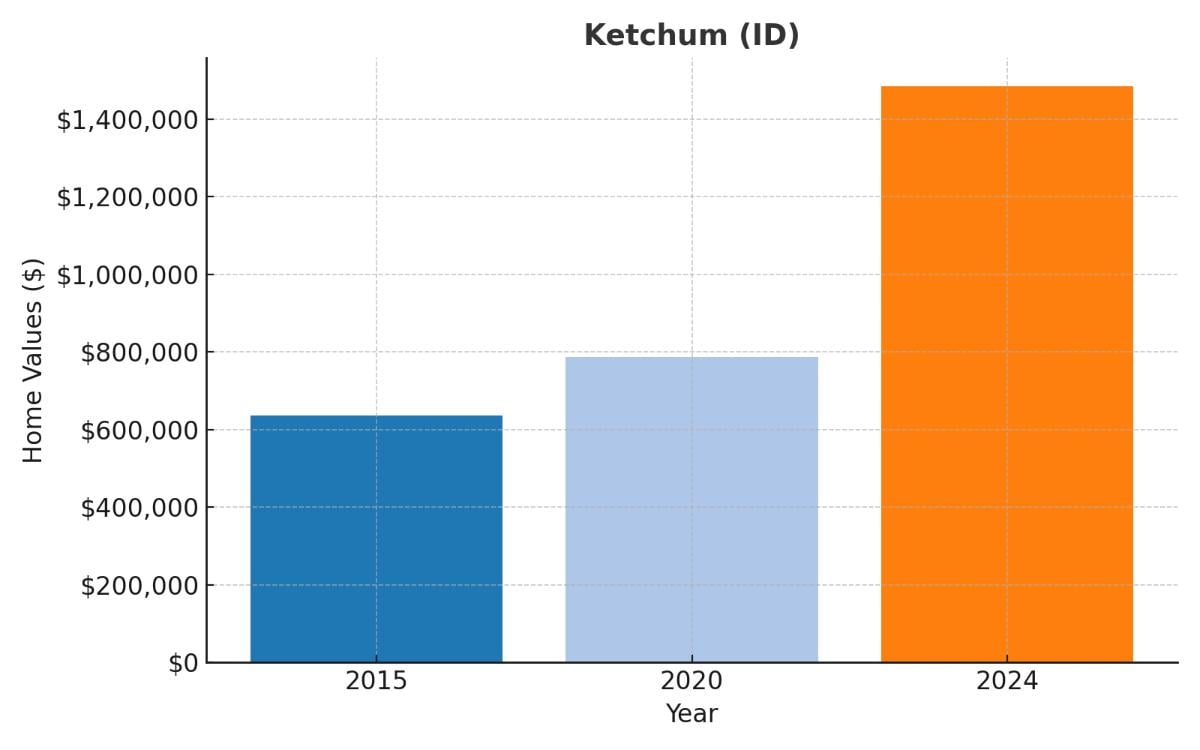

#10. Ketchum (ID)

Home to Sun Valley Resort, America’s original destination ski resort, Ketchum combines luxury amenities with small-town charm. The market has strengthened to $1,483,922 in 2024, rising from $786,925 in 2020 and $636,704 in 2015, representing a 133.1% increase. Its legendary sun exposure and celebrity culture maintain strong values.

#9. Park City (UT)

Located just 35 minutes from Salt Lake City International Airport, Park City offers unparalleled accessibility and extensive terrain. Values have risen to $1,568,722 in 2024, from $934,776 in 2020 and $676,277 in 2015, showing a 132.0% appreciation. Its hosting of the Sundance Film Festival and recent resort consolidation drive premium valuations.

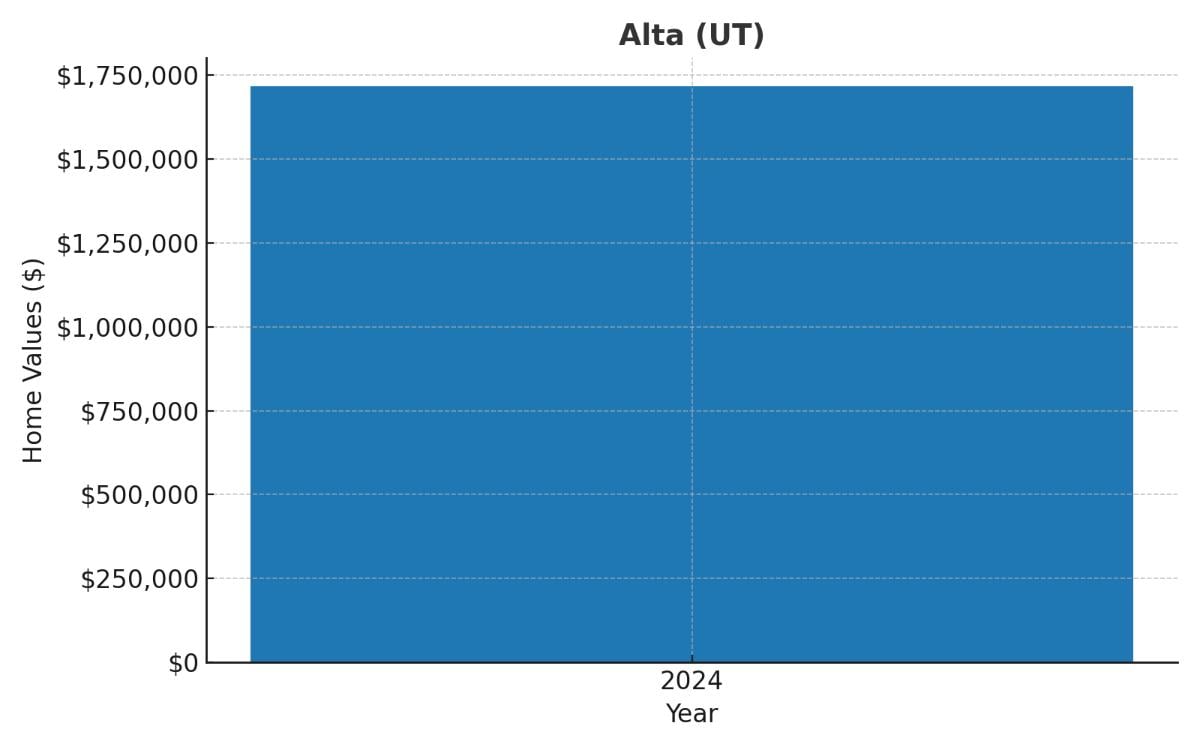

#8. Alta (UT)

Situated at the top of Little Cottonwood Canyon, Alta maintains its focus on skiing with a ski-only policy. The market reached $1,716,630 in 2024, though historical data isn’t available for comparison. Its legendary powder conditions and limited real estate inventory support high valuations.

#7. Vail (CO)

Home to North America’s largest single-mountain ski resort, Vail features a purpose-built village inspired by European resorts. Values climbed to $1,729,853 in 2024, from $988,772 in 2020 and $792,212 in 2015, marking a 118.4% increase. Its international reputation and extensive back bowls maintain premium status.

#6. Big Sky (MT)

Located between Bozeman and Yellowstone National Park, Big Sky offers the biggest skiing in America by vertical drop. Property values reached $1,782,872 in 2024, up from $1,073,574 in 2020, with 2015 data unavailable. Its massive terrain and luxury development drive continuing appreciation.

#5. Jackson (WY)

Set in Wyoming’s spectacular Jackson Hole valley, this resort town combines wild western character with sophisticated amenities. The market has appreciated to $1,960,335 in 2024, rising from $1,034,396 in 2020 and $731,452 in 2015 – a dramatic 168.0% increase. Its proximity to two national parks and limited developable land maintain strong growth.

#4. Telluride (CO)

This historic mining town, set in a box canyon surrounded by 13,000-foot peaks, offers dramatic scenery and world-class skiing. Values reached $2,026,355 in 2024, climbing from $1,125,935 in 2020 and $813,170 in 2015, showing a 149.2% gain. Its remote location and preserved Victorian architecture support premium valuations.

#3. Snowmass Village (CO)

Adjacent to Aspen and offering Colorado’s largest vertical drop, Snowmass Village provides a family-friendly luxury alternative. Property values have strengthened to $2,043,715 in 2024, up from $987,708 in 2020 and $889,865 in 2015, representing a 129.7% increase. Its extensive ski terrain and growing base village development attract luxury buyers.

#2. Mountain Village (CO)

The modern, purpose-built sister city to Telluride, connected by a free gondola, Mountain Village offers ski-in/ski-out luxury living. The market has appreciated to $2,276,967 in 2024, rising from $1,225,301 in 2020 and $907,534 in 2015, showing a 150.9% gain. Its elevated location and modern amenities command significant premiums.

#1. Aspen (CO)

Standing as North America’s most prestigious ski destination, Aspen combines sophisticated culture with access to four separate ski mountains. Values have reached an extraordinary $3,413,108 in 2024, climbing from $2,025,277 in 2020 and $1,612,224 in 2015, marking a 111.7% increase. Its unmatched combination of high-end retail, dining, cultural events, and limited geographic expansion potential maintains its position at the pinnacle of ski town real estate. Despite having a lower percentage increase than some emerging markets, Aspen’s absolute price appreciation of nearly $1.8 million over nine years reflects its mature market status and enduring appeal to ultra-high-net-worth buyers.